While there are many different types of loans available, they are broadly classified into secured and unsecured loans. In this article, we will take a look at secured loans, their features, and benefits.

A secured loan is a loan that requires collateral in order to be disbursed. Collateral or security can range from properties, gold, vehicles, etc.

The presence of collateral will ensure that the lender has something to fall back on in case you default on your loan. This also means that the interest rates will be lower for these loans as the risk is lower for the lender.

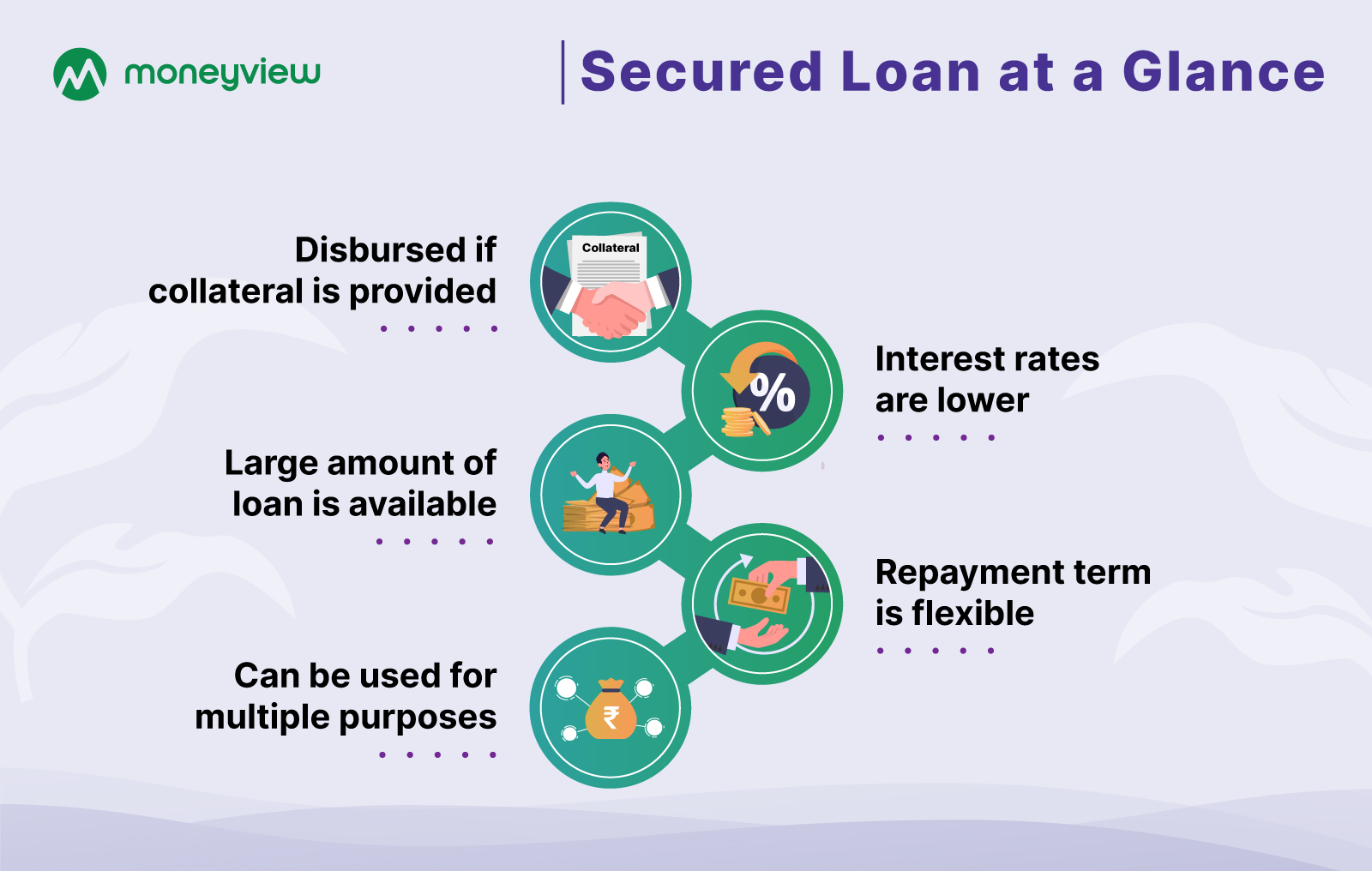

The salient features of secured loans are -

It is disbursed only after the collateral is provided

Lower Interest rates due to the presence of security

Longer and more flexible repayment tenures

Customizable according to the specific needs of the borrower

Secured loans have many benefits over unsecured loans. Some of them are mentioned here -

Repaying secured loans is a great way of building your credit score

Secured loans enable you to spread the cost over time

Due to low risk, lenders usually grant large amounts as secured loans

Secured loans can be used for any purpose such as loan consolidation, home improvement, etc.

There are various types of secured loans that you can avail of. Some of them are mentioned here -

Vehicle loans, also known as auto loans, are secured loans where the purchased vehicle acts as collateral. The lender transfers the ownership of the vehicle to your name once you have paid off the loan.

A mortgage loan can be taken against any property that you own. The lender runs a valuation of the property and offers you a loan accordingly. You can then use this loan amount for any purpose, and get your property released once you pay off the loan.

These secured loans use the funds in your savings account as collateral. Depending on their valuation, the loan amount is approved.

These work just like regular credit cards but are given against a fixed deposit. Your credit limit is generally up to 75-80% of the deposit amount.

In case of a line of credit, you have a set limit and you can borrow any amount within it. When you pay it back, the limit again goes up to the maximum amount. A secured line of credit works in the same way but is provided to you against an asset or collateral.

In such loans, you can use your car title or any other valuable, such as jewellery, tools, etc. as collateral. You need to be careful about such loans as the interest rates are generally high, and you may lose your asset if you fail to repay the loan.

Just like other secured loans, in this case, you can keep your insurance policy as collateral. Depending on the cash value of your policy, your loan amount and terms are decided.

These loans are for people who have a poor credit history. They work just like secured LOC, loans against savings, or secured credit cards. Just note that a poor credit score along with a secured loan may translate to high interest rates.

Now that we know what secured loans are and their types, let’s learn where you can get secured loans. Here is a list of top banks that provide secured loans -

State Bank of India

HDFC Bank

Axis Bank

Punjab National Bank

ICICI Bank

Before digging into the details of secured loans, let’s learn in short what sets them apart from unsecured loans.

Secured loans are backed by collateral such as property, or insurance, whereas unsecured loans have no such backing. Secured loans are a viable option for people with poor credit history or no credit history at all. They can also be a great fit if you’ve experienced financial hardship and are looking for ways to rebuild your credit.

Loans Against Securities are a type of secured loan that involves pledging your shares, mutual funds, and life insurance policies as collateral for your loan. Such loans are typically offered as an overdraft facility to your account after you have deposited your securities.

You can use the LAS facility to draw money from your account, and you pay interest only on the LAS amount you use and for the period you use it. These loans are suitable for those who require instant liquidity for personal or business purposes and can repay them within a short time frame.

Loan Amount

Min ₹10

Max ₹10,000,000

Rate of Interest

Min 5%

Max 25%

Loan Tenure

5

months

Min 3 months

Max 72 months

Secured loans are given against collateral or an asset. It gives banks or lending institutions added guarantee about you repaying the loan. This is why secured loans often have lower interest rates.

It is a good idea to keep any idle asset collateral to get a loan at more affordable terms. If you are careful about paying the EMIs on time and managing your finances, it can be very profitable for you. However, if you default, there is the risk of you losing your asset.

Need Quick Cash?

Mortgages, vehicle loans, secured lines of credit, and loans against property, are a few examples of secured loans.

Secured loans are loans given to borrowers against collateral. Loan applicants can pledge their property or any asset as collateral with the lender.

In unsecured loans, borrowers do not pledge collateral. Instead, lenders extend the loans based on the applicant’s creditworthiness. These loans come with higher rates of interest as they pose a risk to the lender.

Since secured loans require borrowers to pledge their assets as collateral, when a borrower defaults on the loan, the lender has the right to sell the collateral to retrieve the balance loan amount.

Best Personal Loan Resources

Personal Loan Types and Comparisons

Personal Loan Insights and Guides

Personal Loan in Top Cities

Credit Card Insights

CIBIL Score Check and Boost Guide

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?