If you are in the market for a loan, you might have heard a lot about secured and unsecured loans. While both the loans cater to the needs of the borrower, when it comes down to credit score and the qualifications, they differ entirely. In this article, we will give you insights into what unsecured loans mean, how to avail one, and how secured and unsecured loans differ.

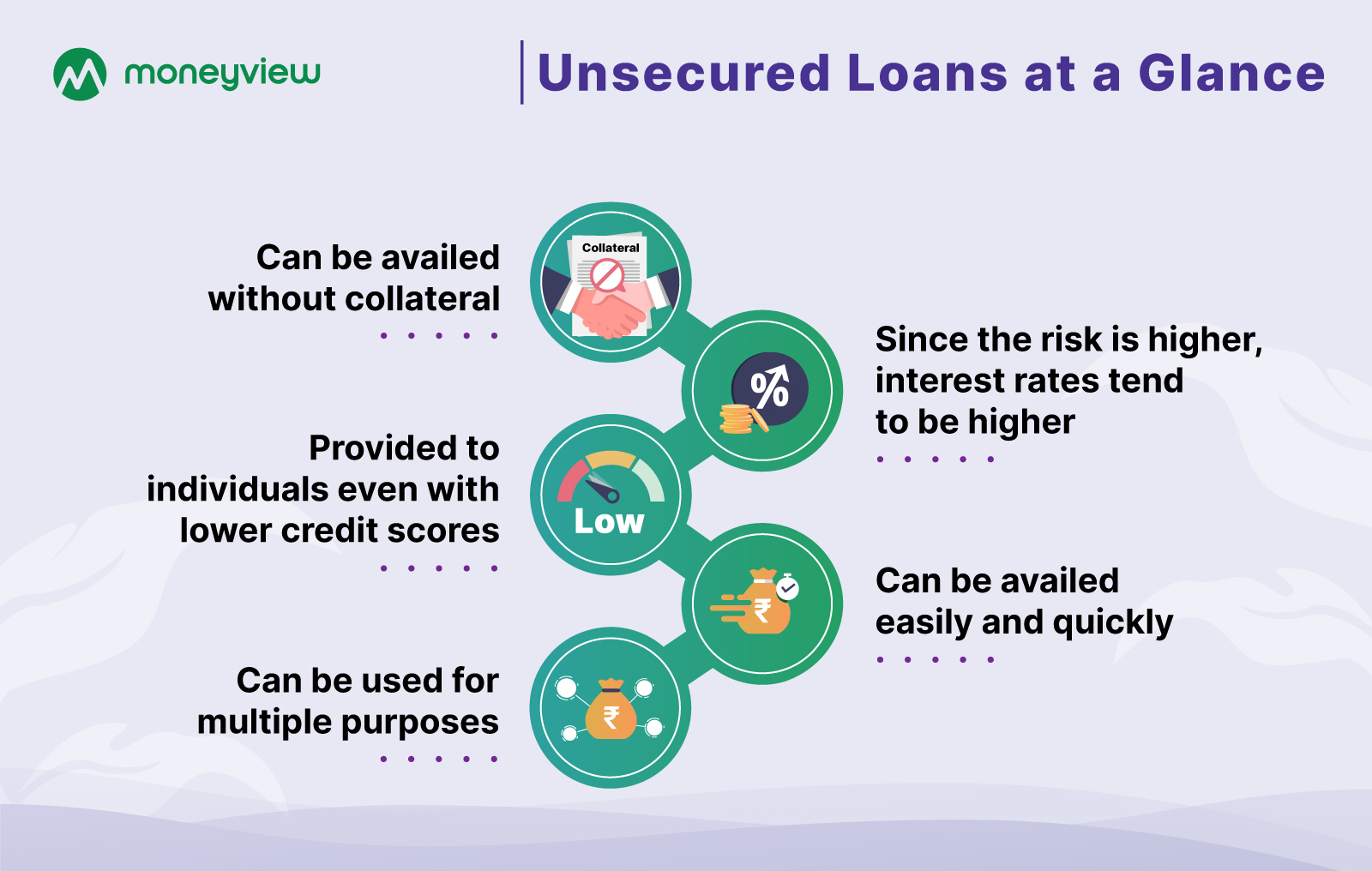

An unsecured loan is a loan given to the borrower without leveraging any collateral such as property or other assets. The lender loans the money solely based on the creditworthiness and income. Since there are no assets to evaluate, the loan approval will be completed faster.

It is in contrast to a secured loan that requires the borrower to submit some collateral for the loan. To avail an unsecured loan, the borrower must have a high credit score. In some cases, if the loan applicants have insufficient credit, lenders will allow the borrower to have a cosigner. In case the borrower defaults the loan, the cosigner will be asked to repay the debt.

Unsecured loans are riskier for the lender and therefore, have a higher interest rate. Before approving the loan, the lender evaluates the financial status of the borrower to determine if the borrower could repay the loan.

Some examples of unsecured loans are personal loans, student loans, and credit cards.

Unsecured loans can be broadly classified into revolving loans and term loans.

A revolving loan comes with a credit limit. A borrower can only withdraw up to the limit at any given time. Revolving loan allows the borrower to utilize a certain amount, repay and continue re-using the available credit again. Owing to its repayment and re-borrowing accommodations, it is considered a flexible financial solution.

A term loan is a personal loan in which the borrower receives a lump sum at once and repays it in fixed installments until it is fully paid. Most consumers generally opt for a term loan to purchase any assets or for investment purposes.

These loans are offered at a fixed interest rate.

And there is also debt consolidation loan, which is taken to pay off existing credit card or personal loans. While it helps to pay off the debt sooner and boosts credit, consolidation loans sometimes come with a higher rate of interest and involve up-front costs such as loan origination fees, balance transfer fee, etc.,

Loan Amount

Min ₹10

Max ₹10,000,000

Rate of Interest

Min 5%

Max 25%

Loan Tenure

5

months

Min 3 months

Max 72 months

Unsecured loans are a popular financing option. Here are some benefits that unsecured loans offer to the borrowers.

Unsecured loans do not require the loan applicant to provide financial assets as a collateral. It provides borrowers with low credit scores a means to secure a loan without providing any collateral.

This is extremely beneficial to small business owners, who need some financial help to bring their business to the forefront. The risk of losing assets is no longer a concern with unsecured loans.

There are no set of rigid constraints to qualify for unsecured loans. It is comparatively more flexible than other types of loans. With a good credit history and a steady stream of income, you can secure a loan hassle-free.

All one needs to do is provide the necessary documents and the loan will be processed.

Since minimal documentation is involved, the loan is approved in a very short amount of time. It is simple, convenient and the amount is disbursed quickly which is handy in emergency situations.

In addition, with the advancement of technology, the loan procedures have become entirely automated and paperless, facilitating a swift approval process.

Borrowers need not submit any laid out plan on how they are going to spend the loan and can be used for any purpose.

| Secured Loan | Unsecured Loan |

|---|---|

| A secured loan is connected to a collateral | No collateral is required for unsecured loans |

| Since an asset is provided as a collateral, secured loans come with low rates of interest. | Unsecured loans are riskier for the lender, so they usually come with higher rates of interest. |

| Secured loan requests typically take around 2-4 weeks for approval | As no verification and documents are required, unsecured loans are easier and quicker to obtain |

| Repayment periods range from 6 months to 20 years | Repayment terms can range between 3 months to 5 years |

| Requires high credit score | While a good credit is required, certain lenders such as Moneyview offer loans to those with CIBIL scores above 600 |

| Takes more time to verify the collateral and process the documents | Quick approval rate |

With all its benefits, unsecured loans are gaining immense popularity among today’s businesses. The market of unsecured loans has experienced substantial growth in the past few years.

One of the premier lenders in the country, Moneyview offers unsecured personal loans of upto Rs. 5 lakh. These loans can be availed in a hassle-free manner within 24 hours of application approval. Visit the website or download the app and apply now!

Need Quick Cash?

Best Personal Loan Resources

Personal Loan Types and Comparisons

Personal Loan Insights and Guides

Personal Loan in Top Cities

Credit Card Insights

CIBIL Score Check and Boost Guide

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?