KYC stands for "Know Your Customer". It's a process used by financial institutions to verify the identity of their customers. This helps to prevent fraud and money laundering.

If you still have questions like ‘what is KYC in bank’ or ‘what is KYC document’, then read on.

KYC stands for 'Know Your Customer,' and it is an effective way for an institution to verify and authenticate a customer’s identity.

This process was introduced under the Prevention of Money Laundering Act, 2002. Since 2004, the RBI has required all financial institutions to verify the identity and address of all customers before conducting financial transactions with them. Both online and offline KYC are acceptable and need to be done only once.

KYC verification processes can be classified into two types. Both are equally good, and it depends on the customer which one they prefer. The types are -

It is an online KYC, also referred to as electronic KYC. In this process, a customer’s address and identity are verified electronically through Aadhaar authentication.

eKYC (Electronic KYC) is a digital customer KYC verification procedure in which the details of a customer are electronically verified

This is required for anyone who wishes to use the services of a financial institution

It helps provide the customer’s proof of identity and address to the service provider, eliminating the need for time-consuming in-person verification

eKYC is primarily concerned with KYC verification via the UIDAI (Unique Identification Authority of India) database and is entirely paperless, and requires no physical documentation

The only requirement for eKYC is that you have to have your 12-digit Aadhaar number and that your mobile number is registered and linked to your Aadhaar card

This process is carried out in person, and a customer’s address and identity are verified through hard copies of documents.

This process is convenient for anyone without access to an internet connection

The customer can do so by visiting a KYC kiosk to authenticate their identity using Aadhaar biometrics

It may also involve submission of attested copies of PAN card, passport, Voters’ ID card, electricity bill, etc.

They can also call the KYC registration agency and have an executive come to their home/office to do so

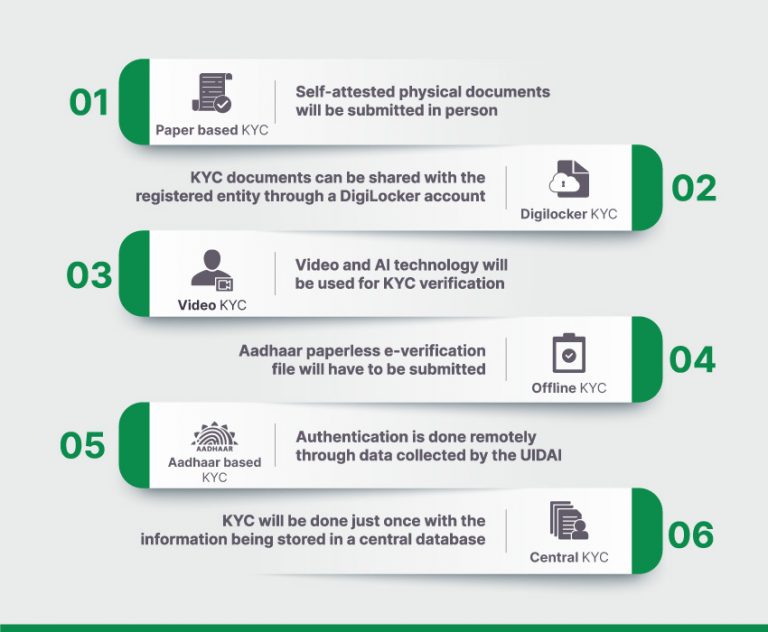

There are five methods of KYC verification. Take a look at them here -

Following the steps outlined below, Aadhaar OTP-based KYC online verification can be completed:

STEP 1: Visit the bank's or KYC Registration Agency's website.

STEP 2: Select ‘KYC verification’.

STEP 3: Enter the information requested from your Aadhaar card.

STEP 4: Authenticate with an OTP sent to the Aadhaar-registered mobile number.

STEP 5: Fill out and upload the application.

Following submission, your KYC application will be verified and approved by the UIDAI (Unique Identification Authority of India).

If you want to know ‘what is KYC in bank’, the following are the steps for it -

STEP 1: Download the KYC form from the bank's or KYC Registration Agency's website.

STEP 2: Fill out the form with your Aadhaar card and PAN information.

STEP 3: As proof of identity and address, provide a copy of any of the listed KYC documents.

STEP 4: Visit a bank, KYC Registration Agency, or investment firm.

STEP 5: Submit the application at your local bank branch.

STEP 6: You may be asked to provide biometric information there.

After submitting the KYC application, you will be assigned an application number. This number can be used to check the status of your KYC verification.

This is a new initiative by the UIDAI to secure your data when it is being shared. This will help an organization verify your identity without having to collect or store your Aadhaar number. To make use of this method, your mobile number must be linked to your Aadhaar card.

You can follow these steps to generate your Paperless Offline e-KYC -

STEP 1: Go to the official myAadhaar website and log in using your Aadhaar number.

STEP 2: Enter the Captcha and click on ‘Send OTP’. Enter the OTP that you received on your registered mobile number.

STEP 3: Once you log in, the list of services will open up. Choose ‘Offline KYC’.

STEP 4: You will be asked to create a 4-digit share code. Input the code of your choice and remember it.

STEP 5: You will need to enter this 4-digit share code with anyone whom you want to share the ZIP file.

STEP 6: Finally, click on ‘Download’. A ZIP file will be downloaded.

STEP 7: Go to the ‘Downloads’ section of your system.

STEP 8: Right click on the ZIP file that got downloaded, and select the ‘Extract’ option. If it asks for a password, enter the 4-digit share code you created.

STEP 9: Your Paperless Offline e-KYC is ready to be shared further.

It is a central depository of customers’ KYC documents. Some of its features are -

It reduces the burden of submitting KYC documents each time you need to complete your KYC.

It is a 14-digit number linked to the ID proof and your data, including any changes made, is safely stored in an electronic format.

The documents that are submitted are verified by the issuer.

Here are the steps you need to follow to complete the Central KYC -

STEP 1: Locate a financial institution, either online or offline, that is registered with CKYC. It could be banks, insurance companies, or any other financial institutions.

STEP 2: Submit documents like your Aadhaar card, PAN card, and your address proof.

STEP 3: Your documents will be verified with the respective issuing authorities.

STEP 4: Once verified, you will receive a unique CKYC number.

This method came around due to the restrictions during the pandemic. It is completed via a video call, and a trained agent is involved in the process. The steps involved are mentioned in detail below -

STEP 1: Select the option for video KYC if available, and schedule a video call appointment.

STEP 2: Keep your PAN, Aadhaar, or any required document handy. You might also need a white paper and pen.

STEP 3: Join the call and follow the instructions. You will need to be in natural light and hold your ID card close to your face.

STEP 4: Once done, your identity will be verified and KYC will be completed.

You have the option to share their KYC documents with the registered entity through your digilocker account. Digilocker is a secure cloud-based platform that stores your digital documents. This is a flagship initiative by the Ministry of Electronics and IT.

Follow these steps to complete your KYC via DigiLocker -

STEP 1: Log in to the DigiLocker website or app and go to ‘Issued Documents’ → ‘Aadhaar Card’ → ‘Refresh’.

STEP 2: Allow DigiLocker to get your KYC details.

STEP 3: Click ‘Update’ and enter the OTP received on your registered mobile number.

Importance of KYCIf the meaning of KYC is not completely clear yet, maybe reading further will help you. KYC is an important tool because it protects financial institutions and prevents illegal activities. Often, non-individual customers make extensive use of financial services such as opening a bank account, trading, and mutual fund investing. In such cases -

All in all, KYC helps verify the authenticity of an individual and/or company. |

In September 2018, the Supreme Court issued a landmark decision prohibiting private entities from using Aadhaar eKYC for verification. Following that, UIDAI granted Aadhaar eKYC to private establishments for authentication purposes.

The Aadhaar and Other Laws (Amendment) Act of 2019 paved the way for online KYC verification, in which individuals voluntarily use their Aadhaar numbers to verify their identities, either through Aadhaar-based online KYC or offline eKYC.

Thus, the new stringent rules allow KYC verification online only for private entities that have been verified by the UIDAI, preventing the misuse of your Aadhaar data.

Documents required for KYCWere you searching for ‘what is KYC document’? Then the answer is here! Here are the documents that you will need to complete your KYC process. There are generally two types of KYC documents accepted as proof - proof of identity and proof of address. 1. Proof of IdentityThis is required to establish an individual's identity. The following documents are generally accepted as proof of identity -

2. Proof of AddressThis is intended to serve as proof of an individual's place of residence. Any one of the following documents is generally accepted as proof of identity -

In some cases, a document submitted may serve as both proof of identity and address, and separate documents might not be necessary. |

The following are the benefits of KYC:

Aids you in efficiently accessing and assessing the client's past financial history in terms of assets and liabilities, allowing you to perform an accurate risk assessment.

Allows you to effectively reduce your exposure to fraud by accurately verifying the client's identity claim.

Prevents you from participating in terrorism or money laundering activities without your knowledge or consent.

Reduces the overall risk of your lending portfolio, contributing to higher profit margins.

KYC is mandatory if you wish to conduct any type of financial transaction. Completing your KYC in time helps you keep your bank account (or any other account)safe. To prevent fraud, the RBI mandated that all transactions be carried out only after a careful assessment of the customer's identity and address.

You can now complete your KYC process within minutes on most apps using options like paperless KYC and video KYC. So, don’t delay completing your KYC!

KYC simply means Know Your Customer. It has been put in place to authenticate you, and protect you from frauds or illegal activities.

In banking you need to complete your KYC from the beginning, i.e., when you open an account. You may also require to frequently update your KYC.

The main documents that you need to complete your KYC are your identity proof and your address proof. They can be any of your OVDs (Officially Valid Documents).

Yes, the process of KYC is completely safe. In case you are worried about your safety, you can use the KYC offline paperless process, and no one will be able to view your details without your permission.

There is no fee for KYC. It is completely free.

Banking & Investment Tips

Tax, Filing & Linking Guide

Finance and Banking Articles

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?