Home

>

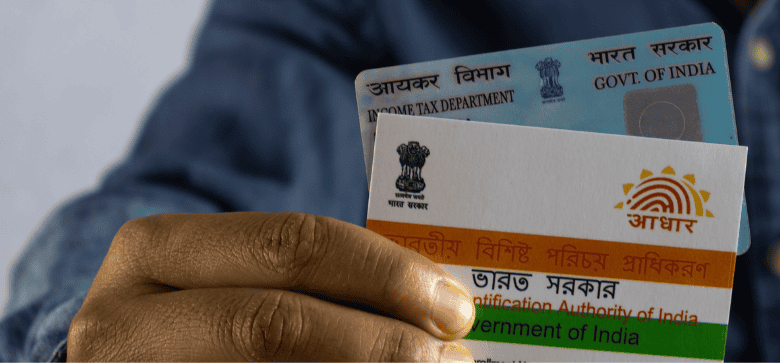

Pan Aadhaar Link

It is mandatory to link your PAN with your Aadhaar card. But in case you have not done it yet, and are searching for information on the PAN-Aadhaar link, you’ll find it right here.

News Update

The last date to link your Aadhaar with PAN is December 31, 2025, and taxpayers who miss this deadline may face a ₹1,000 penalty under the Income Tax Act. Authorities warn that failing to link the two could also lead to the PAN becoming inoperative.

- As reported by The Times of Indiaon 29 December 2025

The Indian government has made it mandatory for everyone to link their Aadhaar with PAN card to increase transparency. The deadline to link these two documents is 30 June, 2023.

There are two steps to this process -

Pay the penalty of Rs.1000

In this article, we will discuss how to pay the penalty of Rs. 1,000 and the various methods to do this. In case you have already completed your PAN-Aadhar link, click here to check the status of this procedure.

Your search for all processes regarding ‘PAN Aadhaar link online’ ends here!

It is easy to link your PAN and Aadhaar online. You can do it either as a registered user, i.e., post-login, or as an unregistered user, i.e., without logging in.

The first step involved is to make the payment, which can be done in two ways -

The first way to complete the payment is through the e-filing portal. To follow this, you must have a bank account in any of these banks as on 13/01/2023 -

Axis Bank

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

City Union Bank

Federal Bank

ICICI Bank

IDBI Bank

Indian Bank

Indian Overseas Bank

IndusInd Bank

Jammu & Kashmir Bank

Karur Vysya Bank

Kotak Mahindra Bank

Punjab National Bank

UCO Bank

Union Bank of India

Then, you can follow these steps below -

Step 1: Visit the e-Filing Portal home page. Click on ‘Link Aadhaar’ under the ‘Quick Links’ section.

Step 2: On the next page, enter your PAN and Aadhaar Number.

Step 3: Select ‘Continue to Pay through e-Pay Tax’ in the pop-up box.

Step 4: Enter your PAN, then confirm it, and enter your mobile number. You will receive an OTP.

Step 5: Enter the OTP that you received. Once it is verified, you will be redirected to the e-Pay Tax page. Click on ‘Continue’.

Step 6: Click on ‘Proceed’ on the Income Tax Tile.

Step 7: Select your Assessment Year as applicable and ‘Type of Payment’ as ‘Other Receipts (500)’.

Step 8: Then click on ‘Continue’.

Step 9: The applicable amount will be pre-filled against ‘Others’. Click on ‘Continue’.

The challan will be generated, and on the next screen, you will have to select the mode of payment. After this, you will be redirected to your bank’s website where you can make the payment.

The second way of completing the payment is through Protean or NSDL. If you don’t have a bank account in the banks listed above, you can follow these steps -

Step 1: Visit the e-Filing Portal home page. Click on ‘Link Aadhaar’ under the ‘Quick Links’ section.

Step 2: Enter your PAN and Aadhaar Number on the next page.

Step 3: A pop-up box will appear. Click on ‘Continue to Pay through e-Pay Tax’.

Step 4: Click on the blue hyperlink given below on the e-Pay tax page. The link will take you to the Protean (NSDL) Portal.

Step 5: Once you are on the Protean (NSDL) Portal, click ‘Proceed’ under Challan No./ITNS 280.

Step 6: Select the ‘Tax applicable’ as 0021 and ‘Type of Payment’ as 500.

Step 7: Select your Assessment Year as applicable and other mandatory details. Finally, click on ‘Proceed’.

Once the payment is done, you can link your Aadhaar with PAN on the e-Filing Portal.

If you pay through this method, you can complete your PAN-Aadhaar link only after 4 or 5 days of making the payment.

Now that you have made the payment, the next step is to complete the actual link.

The PAN card is an extremely important piece of document in the banking sector, or in any case of big financial investments. The PAN card helps the government track your financial transactions and levy taxes on them when required.

Similarly, even your Aadhaar card is an essential document in the country. It is your unique identity number, and can act as both your identity and address proof.

Here are some reasons to link the two documents -

First and foremost, it has been made mandatory by the government

It will be necessary to file IT returns in the upcoming years

It will provide an audit trail to the government, which will allow the IT department to track unlawful transactions and stop revenue drainage

Individuals with multiple PAN cards will not be able to evade taxes, as all the cards will be linked to a common Aadhaar card

Thus, the government and the individual taxpayers will benefit from this mandatory regulation.

Linking your PAN card with your Aadhaar card does come with some advantages -

Following are the steps to link your PAN and Aadhaar cards manually.

If you are unable or ignorant about linking your PAN and Aadhaar card, you will not be able to file for IT returns and TDS files from March 2023 onwards.

The Income Tax department will deactivate your PAN card; thus, any transactions or earnings you have will be deemed illegal. Besides, you will be unable to make genuine transactions above INR 50,000.

Even if your income is below the taxable limit as the government prescribes, you must link your Aadhaar with your PAN card. Or else your PAN card will be deactivated.

The ways to verify the status of your PAN-Aadhaar status before logging in are listed below:

You can also use the SMS service to check the progress of the Aadhaar-PAN linkage. To do this, send an SMS to 567678 or 56161 in the following format:

UIDPAN <12-digit Aadhaar number> <10-digit Permanent Account Number>

Once your Aadhaar has been successfully linked to your PAN, the following message will appear -

'Aadhaar (Aadhaar number) is already associated with PAN in the ITD database. Thank you for making use of our services.’

While linking your PAN card to your Aadhaar, you might receive some errors. This can stem from a few reasons, which can be listed down below.

Such problems can lead to great inconveniences and wastage of time. Hence we should be equipped with how to tackle them effectively.

If your Aadhaar card and PAN card details do not match, you can change either of them to match your original credentials. You need to follow these simple steps to rectify your PAN card details.

Here are the steps that you can follow to rectify your Aadhaar credentials. Please note that this process is offline.

Visit the nearest official Aadhaar enrollment center with all the required documents.

There, you will be provided with an Aadhaar enrollment form, which you need to fill out with accurate details.

Next, submit the form along with the necessary documents to the concerned authorities.

Once done, you will be given an acknowledgment slip that will contain the updated request number. You can use this number to check the status of your Aadhaar update request.

Yes, as of now, you have to pay a fee of INR 500 only if the linking is done by 30th June 2022. After that, the charges will be increased to INR 1000. Therefore, you must get the linking done at the earliest.

Related Aadhaar Articles:

How to Change Mobile Number in Aadhar Online

How to Check Aadhaar Card Link with Mobile Number

How to Download Aadhar card Download without Mobile Number

How to Change Date of Birth in Aadhar Card

How to Change Mobile Number in Aadhar without OTP

How to Link EPF Account with Aadhar

Income Tax Aadhar Link

Aadhar Bank Link

Link Aadhaar with Mobile Number

Pan Aadhaar Link

Link Voter ID with Aadhaar Card

Link UAN with Aadhaar Card

Ration Card Aadhar Link

Download E-Aadhaar Card

The Aadhaar number is an identification number issued to every citizen of India by the Unique Identification Authority of India (UIDAI). It serves as proof of identity and address and can be used for registration with various government agencies like banks, financial institutions, health care providers, etc.

The Permanent Account Number, or PAN, is an identification number issued by the Income Tax Department of India. The 10-digit number is unique to every individual and is one of the most important documents to set up a bank account, buy shares or invest in mutual funds, etc.

Under the current laws, it is mandatory for every Indian citizen to link their PAN cards and Aadhaar cards. In failing to do so, the PAN card will become inoperative post April 1, 2023. If your PAN becomes invalid, you will be unable to conduct financial transactions where the PAN is required. These include opening a bank account, filing an income tax return, claiming a tax refund, and investing in stocks and mutual funds, among other things.

Aadhaar Card Help and Update Guides

Best Personal Loan Resources

Credit Card Insights

Tax, Filing & Linking Guide

Banking & Investment Tips

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?