20th November 2025

The deadline to link your PAN and Aadhaar has been extended to 30 June, 2023. In case you have not completed this process, click here.

Once you have completed this process, follow the steps below to check PAN-Aadhaar link status.

You can check the status of your PAN-Aadhaar link in two ways -

Pre-login

Post-login

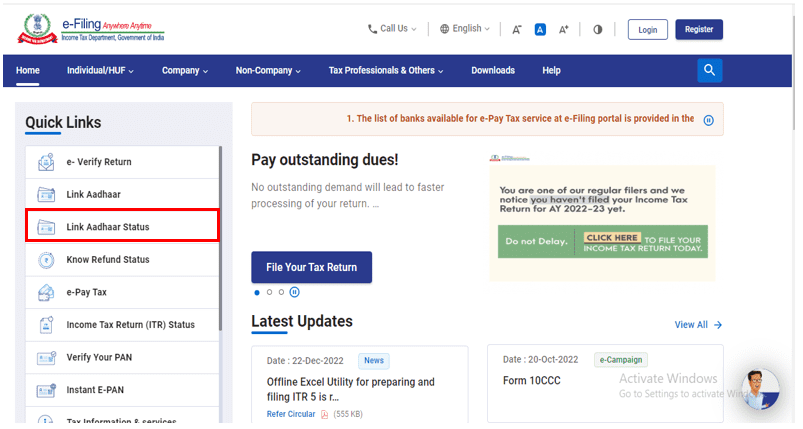

Step 1. Visit the e-Filing Portal Home Page and select ‘Link Aadhaar Status’ under the ‘Quick Links’ section on the left side

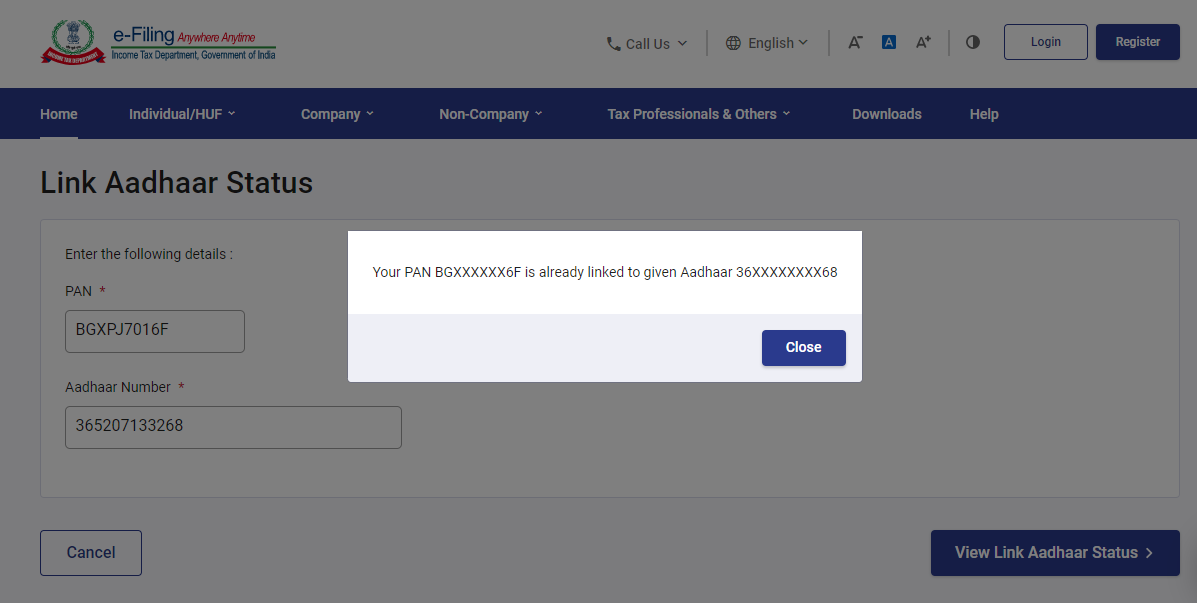

Step 2. Enter your PAN and Aadhaar number and click on ‘View Link Aadhaar Status’

Step 3. If the validation has been successful, you will receive a message saying so.

Step 4. In case the validation is still under process, you will receive the following message -

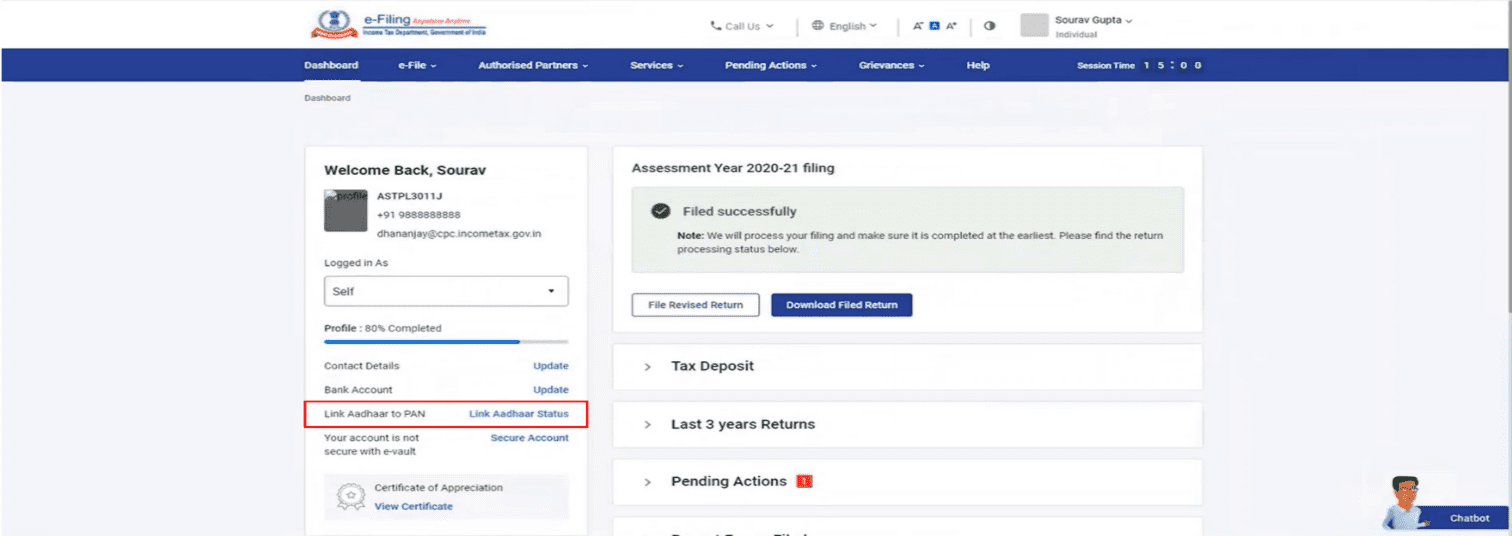

Step 1. Visit the e-Filing Portal and login. Click on ‘Dashboard’ on the top left section and select ‘Link Aadhaar Status’

Step 2. You can also go to your profile and select ‘Link aadhaar Status’. In case your PAN-Aadhaar link is complete, your Aadhaar number will be displayed in your profile. If not, the status will be displayed.

.png)

In case you have not completed the PAN-Aadhaar link, you will have to do so before 30 June 2023 after paying a fine of Rs. 1,000. Your PAN will be inoperable if this process is not completed before the deadline.

Related Aadhaar Articles:

How to Change Mobile Number in Aadhar Online

How to Check Aadhaar Card Link with Mobile Number

How to Download Aadhar card Download without Mobile Number

How to Change Date of Birth in Aadhar Card

How to Change Mobile Number in Aadhar without OTP

How to Link EPF Account with Aadhar

Income Tax Aadhar Link

Aadhar Bank Link

Link Aadhaar with Mobile Number

Pan Aadhaar Link

Link Voter ID with Aadhaar Card

Link UAN with Aadhaar Card

Ration Card Aadhar Link

Download E-Aadhaar Card

Linking your PAN and Aadhaar cards come with a number of benefits. It eliminates card duplication, allows the IT department to detect fraud, and is needed to file taxes as well.

In case you have not completed your PAN-Aadhaar card link yet, do so before 30 June 2023 or your PAN will be deactivated.

No, the following individuals are exempted from completing this process -

Balance Enquiry Numbers Guide

High-Paying Jobs & Their Salaries Guide

Credit Card Insights

Banking & Investment Tips

Tax, Filing & Linking Guide

Finance and Banking Articles

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?