Home

>

What is Service Tax

Taxes are levied on workers’ incomes or business revenues by almost all governments. They are compulsory in nature and contribute to the governance, country’s development, and various public expenditures.

But what exactly is the service tax? Is it still around even today? To find answers to all such questions, read on.

If you want to know ‘what is service tax’, you’ll find its definition here.

Service tax is a type of indirect tax levied by the Government of India on various service providers and transactions.

It was started under the Finance Act, 1994, and the first industries to be taxed were telephone services, non-life insurance related services, and services provided by Stock Brokers. At this stage the service tax was 5% of the gross value of service.

Later, in the year 2003, the service tax was increased to 8%. In 2004, it was 10%, and by 2006, it was increased to 12%. By this time, service tax also extended to cover almost all goods and services.

Let us take a look at the service tax in India at present. The service tax is generally payable by the service provider. But due to ease of governance and tax collection, often the liability of paying the service tax shifts to the service receiver or any other entity.

Since it is an indirect tax, in most cases the service receiver or the client ends up paying the service tax. But the service provider is responsible for collecting it and submitting it to the government.

It is to be noted that as of July 2017, service tax was abolished and Goods and Service Tax (GST) took its place. GST may also vary from state to state. Click on this link to find out the GST rules in your state.

When service tax was started in 1994, it was levied on only 3 types of services. From there on, it expanded to encompass 119 industries or services by the year 2012. However, in 2012, the concept changed.

Instead of listing the services which were taxable, a ‘Negative List regime’ was started. This meant that service tax was being levied on every service other than the ones mentioned in this list.

With this, the revenues received by the Government of India also increased immensely which in turn contributed to the progress of the nation.

Under Section 94 of the Finance Act, 1994, the Central Government came up with certain rules pertaining assessment and collection of Service Tax.

There are 9 service tax rules overall and explain the following -

Defines service tax rules

Defines terms related to service tax

Appointment of officers

Registration of service tax

Records

Payment of service tax

Tax returns

Appeals to Commissioner of Central Excise

Appeals to Appellate Tribunal

To read these rules in detail, click here.

As per a notification dated 1 March, 2005, the following are some of the service tax payment rules -

The tax amount should be paid to the Central Government of India by the 5th of the month immediately after the calendar month where payments are received

In case the assessee is an individual or a partnership firm or a proprietary firm, the amount will be paid on the 5th of the month. But this will be after the quarter where payments are received

It is important to note that individuals who need to pay service tax must register through Form ST-1. This must be completed within 30 days from which the tax amount was charged.

All taxable services (if relevant) can be mentioned in the same form. These are service tax registration rules.

Given below are some services that are exempt from service tax and are continued in GST as well -

Services carried out by the Reserve Bank of India

Services carried out by a foreign diplomatic mission located in India

Services by way of transportation of goods by road (except the services of a goods transportation agency or a courier agency) and by inland waterways

Services provided by a veterinary clinic for health care of animals or birds

Services of admission to a museum, national park, wildlife sanctuary, tiger reserve, or zoo

There are many such services which are exempted from paying GST. The complete list can be found here.

As of 2017, GST replaced most other indirect taxes like the excise duty, VAT, service tax, etc. Thus, chances are that you are paying GST now. Let us take a look at how GST is calculated.

GST is calculated based on the sale of goods and services under the Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), and Integrated Goods and Services Tax (IGST) Acts.

The GST rates in CGST and SGST are approximately the same. The GST rate for IGST is approximately the sum total of the CGST and SGST rate.

Service tax rate varies depending on the product and service.

All businesses that are registered under the GST law must charge GST on the value of supply.

The following are the primary GST slabs for regular taxpayers in India currently -

Nil-rated or 0% (on milk, eggs, unpacked food grains, etc.)

5% (on sugar, tea, spices, etc.)

12% (on butter, processed foods, mobiles, etc.)

18% (on hair oil, toothpaste, soap, etc.)

28% (on consumer durables and luxury items like AC, fridge, BMWs, cigarettes, etc.)

There are two more slabs, which are comparatively less common -

3%

0.25%

The GST law also levies cess (Compensation to States) along with GST rates on the sale of some items such as cigarettes, tobacco, petrol, etc. These rates vary widely from 1% to 204%.

As GST has mostly replaced service tax, here is a detailed guide of making GST payments. It can be done in two ways -

To make the GST payment in the pre-login mode, you can follow these steps -

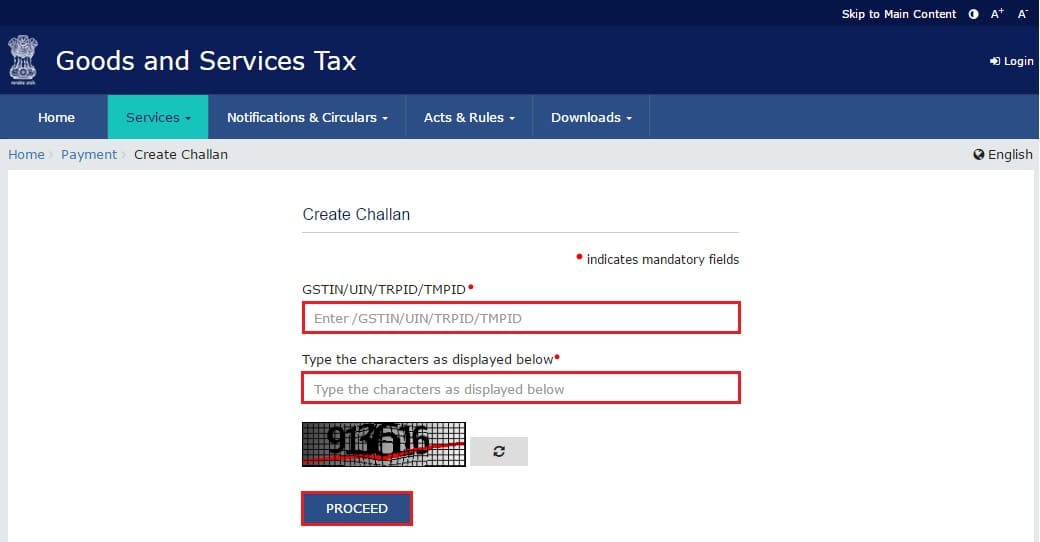

STEP-1: Visit the GST official portal.

STEP-2: Go to ‘Services’ → ‘Payments’ → ‘Create Challan’.

STEP-3: The ‘Create Challan’ page will be displayed. In the ‘GSTIN/UIN/TRPID/TMPID’ field, enter your GSTIN.Then enter the Captcha text in the respective box. Finally, click on ‘Proceed’.

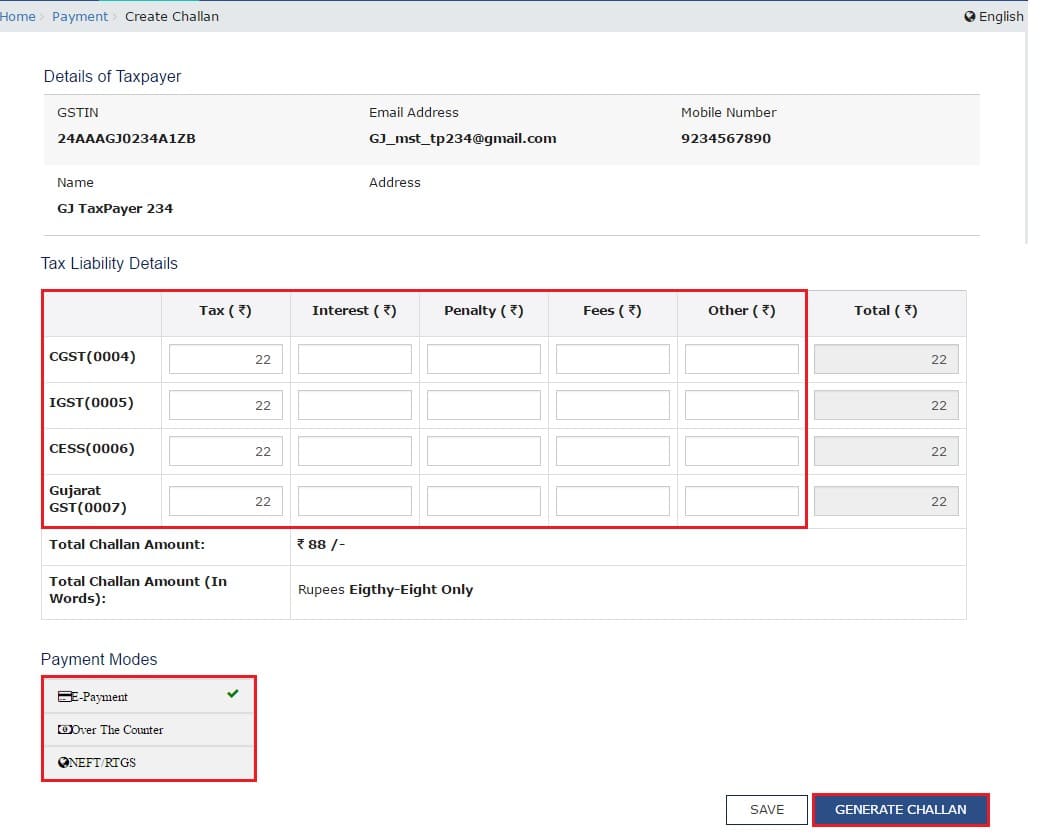

STEP-4: In the ‘Tax Liability Details’ area, enter the details of the payment that you need to make. The ‘Total Challan Amount’ and the ‘Total Challan Amount (In Words)’ fields will be auto-filled with the total amount that you need to pay.

STEP-5: Select one of the three options from the ‘Payment Modes’.

STEP-6 (a): If you select ‘E-payment’, follow these steps -

Click on ‘Generate Challan’ to proceed.

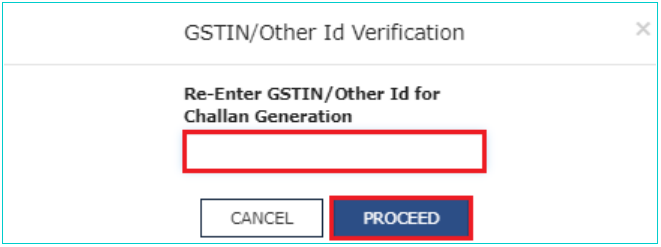

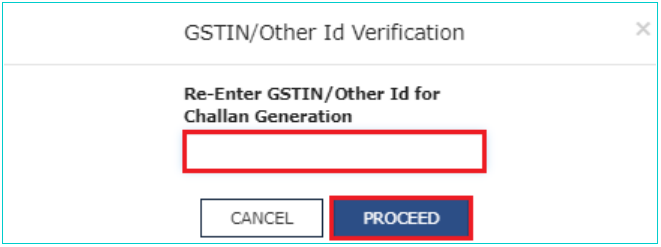

On the ‘GSTIN / Other Id Verification’ pop-up, enter the GSTIN or Other Id in the ‘Re-Enter GSTIN / Other Id for Challan Generation’ field. Click on ‘Proceed’.

The challan will be generated which you can download for further use. From the ‘Select Mode of e-payment’, select ‘Netbanking’.

Also select the bank through which you want to make the payment. Finally click on ‘Make Payment’.

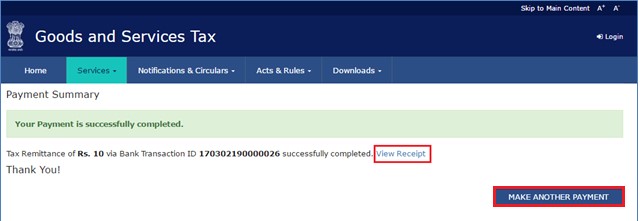

You will be redirected to your bank page for completing the payment. In case of successful payment, you will be able to see your transaction status and receipt.

STEP-6 (b): If you select ‘Over the Counter’, follow these steps -

Select the name of the bank where you want to make the payment.

Select the type of payment you want to make ‘Cash / Cheque / Demand Draft’, and click on the ‘Generate Challan’ button.

On the ‘GSTIN / Other Id Verification’ pop-up, enter the GSTIN or Other Id in the ‘Re-Enter GSTIN / Other Id for Challan Generation’ field. Click on ‘Proceed’

The challan will be generated, which you can download. You will need to take its printout and visit the bank you selected.

You can then pay using Cash/ Cheque/ Demand Draft within the Challan’s validity period.

The status of your payment will be updated on the GST Portal after confirmation from the Bank.

STEP-6 (c): If you select ‘NEFT / RTGS’, follow these steps -

From the ‘Remitting Bank’ drop-down list, select your preferred bank. Then, click on ‘Generate Challan’.

On the ‘GSTIN / Other Id Verification’ pop-up, enter the GSTIN or Other Id in the ‘Re-Enter GSTIN / Other Id for Challan Generation’ field. Click on ‘Proceed’.

The Challan will be generated, which you can download. You will need to take its printout and visit the bank you selected.

Pay using Cheque or the account debit facility in your selected Bank Branch.

Once you receive the Unique Transaction Number (UTR) on your registered e-mail or mobile number, you can link the UTR with the NEFT/RTGS on the GST Portal.

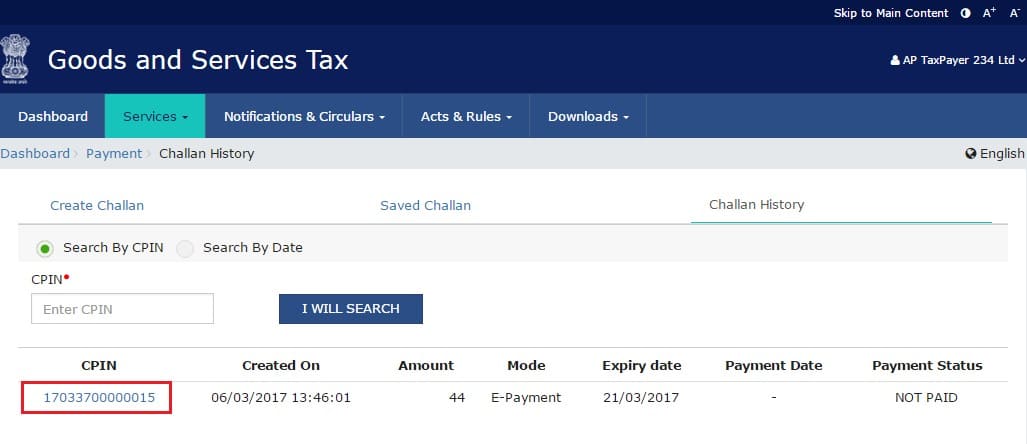

Then, go to Challan History and click the CPIN link. Enter the UTR and link it with the NEFT / RTGS payment.

The status of the payment will be updated on the GST Portal after confirmation from the Bank.

To make the GST payment in the post-login mode, just follow these steps -

STEP-1: Visit the GST official portal and login with your credentials.

STEP-2: You will be able to access the generated challan, by going to Services → Payments → Challan History.

STEP-3: Select the CPIN link for which you want to make the payment. If you do not remember the CPIN number, you can select the ‘Search by Date’ option, which will help you search by the date on which it was generated.

STEP-4: Now, select the mode of payment as per your choice.

STEP-5(a): If you want to make the payment through netbanking, follow these steps -

Select the bank through which you want to make the payment, and tick the ‘Terms and Conditions apply’ checkbox.

Then, click on the ‘Make Payment’ option.

STEP-5(b): If you want to make the payment through credit or debit cards, follow these steps -

Select an option from the ‘Please select a payment gateway’ option, and tick on the ‘Terms and conditions apply’ checkbox.

Then, click on the ‘Make Payment’ option.

You will be redirected to your bank;s website where you can complete the transaction. In case of successful payment, you will see the transaction status and the payment receipt.

STEP-5(c): If you want to make the payment over the counter, follow these steps -

Select the Name of the Bank as per your choice and select the mode of payment as Cash / Cheque / Demand Draft.

Click on the ‘Generate Challan’ option. Print out the challan and take it to the bank branch.

You can pay using Cash / Cheque / Demand Draft within the Challan’s validity period. Once done, the status of the payment will be updated on the GST Portal.

STEP-5(d): If you want to make the payment through NEFT / RTGS, follow these steps -

From the ‘Remitting Bank’ drop-down list, select your preferred bank. Then, click on ‘Generate Challan’.

The Challan will be generated, which you can download. You will need to take its printout and visit the bank you selected.

Pay using Cheque or the account debit facility in your selected Bank Branch.

Once you receive the Unique Transaction Number (UTR) on your registered e-mail or mobile number, you can link the UTR with the NEFT / RTGS on the GST Portal.

Then, go to Challan History and click the CPIN link. Enter the UTR and link it with the NEFT / RTGS payment.

The status of the payment will be updated on the GST Portal after confirmation from the Bank.

Under the new GST rules, following are some of the offenses under CGST/SGST Act -

Supplying goods or services without invoice or with false/incorrect invoice

Issuing an invoice without making a supply

Not paying tax that was collected for over a period of 3 months

Obtaining refund fraudulently

Not registering despite being liable to pay taxes

The act lists a total of 21 offenses, which can be checked out here.

The penalty for committing any of the offenses above will be the higher one of the two options mentioned below -

The amount of tax evaded, fraudulently obtained as refund, availed as credit or not deducted or collected or short deducted or short collected,

A sum of ₹ 10,000

10% of the taxes not paid or shortly paid

How to Change Mobile Number in Aadhar Online

How to Check Aadhaar Card Link with Mobile Number

How to Download Aadhar card Download without Mobile Number

How to Change Date of Birth in Aadhar Card

How to Change Mobile Number in Aadhar without OTP

How to Link EPF Account with Aadhar

Income Tax Aadhar Link

Aadhar Bank Link

Link Aadhaar with Mobile Number

Pan Aadhaar Link

Link Voter ID with Aadhaar Card

Link UAN with Aadhaar Card

Ration Card Aadhar Link

Download E-Aadhaar Card

In the year 2017, the service tax was abolished along with other indirect taxes. The Goods and Services Tax (GST) took its place, thus bringing more order to the system of taxes in India.

There are many advantages to GST such as -

With so many benefits, the GST continues to increase the revenue of the government of India. This improves investment in welfare schemes, infrastructure development, public healthcare, etc.

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?