Top Features and Benefits of Loan on Aadhar Card

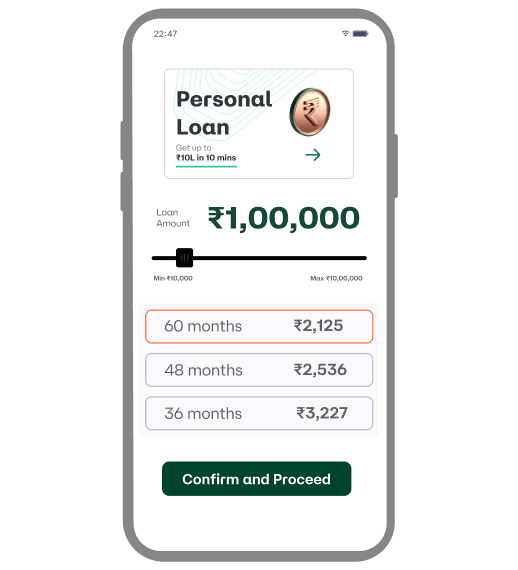

Flexible Loan Amount

Moneyview offers personal loans of up to Rs.10 Lakh based on your requirements

Quick Eligibility Check

Find out your eligibility on the Moneyview website in just 2 minutes

Collateral Free Loans

Moneyview personal loans are unsecured and do not require any assets or guarantors

Affordable Interest Rates

At Moneyview, you can get loans at interest rates starting from 10% per annum