Bengaluru, also known as Bangalore, is the capital of India’s southern state of Karnataka. It is the center of India’s high-tech industry and many people migrate here in search of jobs.

If you are thinking of purchasing a house in the city, it is important to know about property registration charges in Karnataka.

A buyer must pay various taxes in addition to the amount paid to the seller in order to legally acquire the property. Stamp duty and registration fees are the most common types of costs that are imposed.

These charges are mandated by the government under Section 3 of the Indian Stamp Act of 1899 and are collected to authenticate the sale agreement as well as to keep a record of the property. All fees are set by the state government, and thus vary by state.

In the following sections, we'll go over how much money you'll have to pay in stamp duty and registration charges in Karnataka’s capital city, Bangalore.

Let us first look at the amount charged with respect to the types of fees:

Registration charge - 1% of the property value

BMRDA, BBMP, and village areas added cess - 10% on stamp duty

Corporation and BBMP added surcharges - 2% on stamp duty

BMRDA and other charges - 3% on stamp duty

In Bangalore, unlike in the majority of other Indian states, stamp duty is the same for women and men.

| Group | Stamp Duty charges | Registration Charges |

|---|---|---|

|

Single Male Owner Single Female Owner Joint Owners (Male + Male / Male + Female / Female + Female) |

Properties worth more than Rs. 310 Lakhs = 5% |

1% of the estimated property value |

|

Properties priced between Rs.21 Lakh & Rs. 310 Lakhs = 3% |

||

|

Properties priced between Rs. 310 Lakhs & Rs.410 Lakhs = 3% |

||

|

Properties worth less than Rs.20 Lakh = 2% |

In an effort to stimulate the property market, the Karnataka government reduced the stamp duty in Bangalore from 5% to 3% for properties priced between Rs.21 Lakh and Rs.310 Lakhs in May 2020.

For properties worth up to Rs.20 Lakh, the stamp duty was reduced from 5% to 2% in 2019. To address the concerns of those looking for property priced above Rs.310 Lakhs, homebuyers have asked for a 3% flat stamp duty charge on all properties above Rs.21 Lakh.

The stamp duty and registration charges in karnataka on homes worth under Rs.310 Lakhs were reduced recently. You must pay 5% of the whole or registered property value (above Rs.410 Lakhs) in stamp duty and 1% of the total or registered property value in registration fees in accordance with current rates.

Let us look at an example to understand if the reduction in stamp duty has made buying a property in Bangalore affordable.

Let’s assume that a property costs Rs.40 Lakh and the stamp duty is 5%, which works out to Rs.2 Lakh resulting in the overall cost rising to Rs. 42 lakh. With a 3% stamp duty, the amount would be Rs.1.20 Lakh only which means that the cost would be Rs. 41.2 lakh. This indicates that a reduction in the stamp duty rate lowers the overall cost of owning a property.

However, a reduction in stamp duty is insufficient to make homeownership affordable. According to a study by IIM Bangalore, the registration fees have to be reduced as well.

Stamp duty and registration fee reductions are frequently feared by authorities as a threat to the government's revenue. However, according to a study conducted by the National Housing Bank, such reductions encourage those looking for low-cost housing to purchase the property.

As many more units were built under the Housing For All scheme, these charges were usually paid by buyers of land or built property and range between 5% and 13%. It generated additional revenue and compensated for any revenue loss due to stamp and registration fees.

In addition to stamp duty, you will need to budget for the cess and surcharge, as mentioned in the section above.

A 10% cess and a 2% surcharge apply to properties priced above Rs.310 Lakhs. This is also valid in the case of cities and urban areas. As a result, you will have to pay 5.6% in stamp duty. Because the surcharge is 3% in rural areas, a home buyer pays 5.65% as stamp duty.

Here is a step by step procedure to calculate the registration charges for your property in Bangalore -

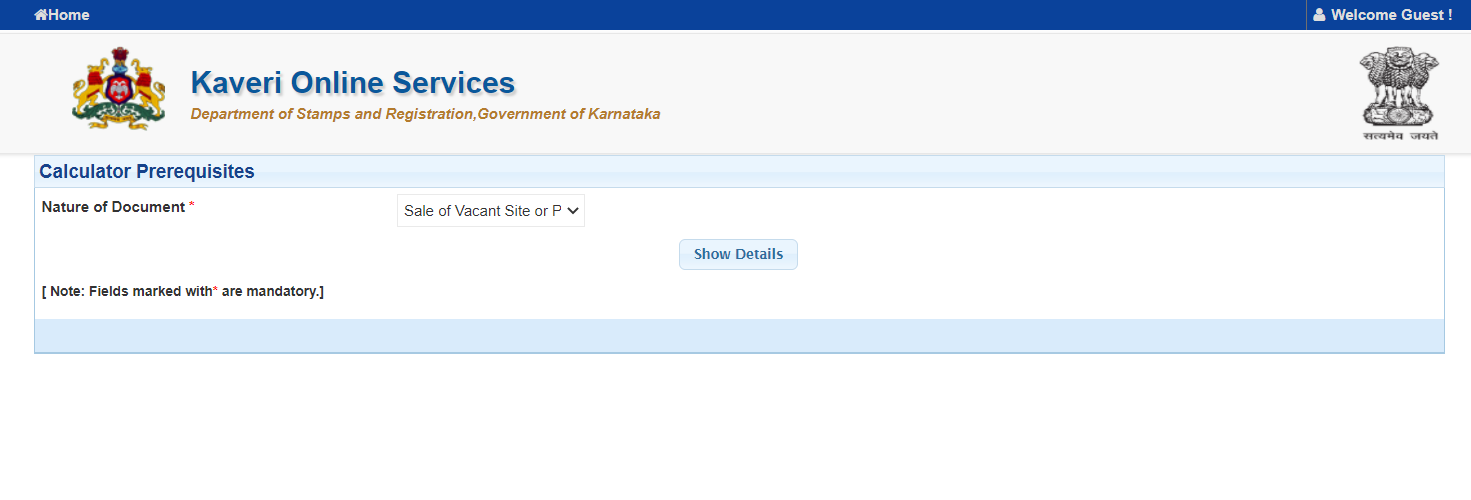

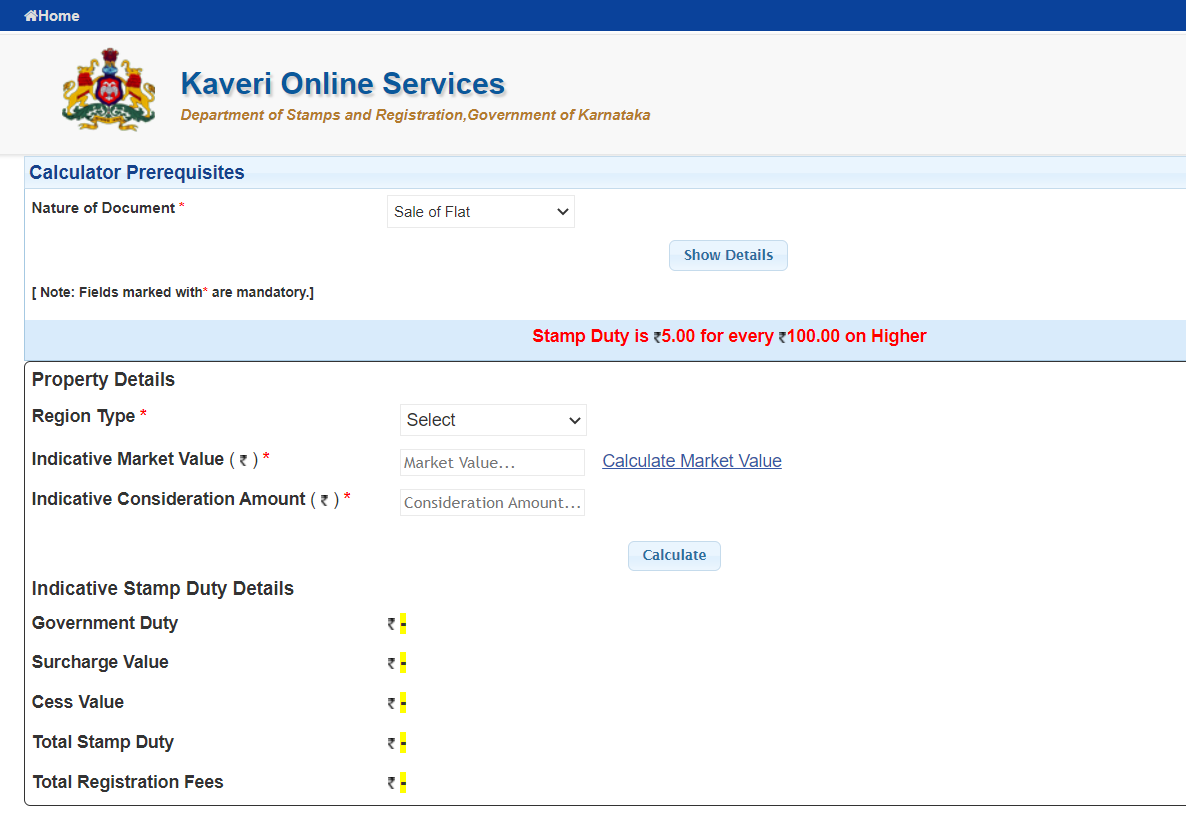

Step 1: Go to the Kaveri Online Services website and fill in the nature of the document to continue. In this case, choose the nature of the document to be "Sale of Flat".

Some other details that you will have to mention are the indicative market value and the indicative consideration amount.

The market value is the value calculated as per the consideration (or ready reckoner, or stamp duty) mentioned in the document, whichever is higher, to arrive at the stamp duty rates and charges. If the consideration value is greater, this will be considered when calculating stamp duty.

If you are unsure of the market value, you can calculate it now using the provided calculator. To proceed, simply click on the ‘Calculate market value' button.

Once you've entered your information, the calculator will display the estimated stamp duty charges, surcharge, cess, total stamp duty, and total registration fees for your property.

Let us take a look at the factors determining stamp duty charges:

How to Change Mobile Number in Aadhar Online

How to Check Aadhaar Card Link with Mobile Number

How to Download Aadhar card Download without Mobile Number

How to Change Date of Birth in Aadhar Card

How to Change Mobile Number in Aadhar without OTP

How to Link EPF Account with Aadhar

Income Tax Aadhar Link

Aadhar Bank Link

Link Aadhaar with Mobile Number

Pan Aadhaar Link

Link Voter ID with Aadhaar Card

Link UAN with Aadhaar Card

Ration Card Aadhar Link

Download E-Aadhaar Card

You need to pay stamp duty and registration charges in order to own a property. Different standards are used to calculate the registration fee and stamp duty for different property types.

In case of multi-storey apartments, the super built-up area is taken into account. If it is a plot, the sq. ft. area of the plot is multiplied by the current guideline value for that area. But, the total constructed area is taken into account in case of independent houses.

The state government usually revises these fees once a year. They are primarily determined by the current market rate of the property, the expansion of city limits, and the performance of the property market. Thus it is important to stay updated and take these into account while calculating the total cost of a property.

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?