Home

>

income tax e-verification-evc

In this article we will explore how you can e-verify your ITR in the following ways -

Using Existing Electronic Verification Code (EVC)

After Generating Electronic Verification Code (EVC) Through Bank Account

After Generating Electronic Verification Code (EVC) Through Demat Account

Using Net Banking

If you wish to, e-verify your ITR using Digital Signature Certificate and Aadhaar OTP, click here.

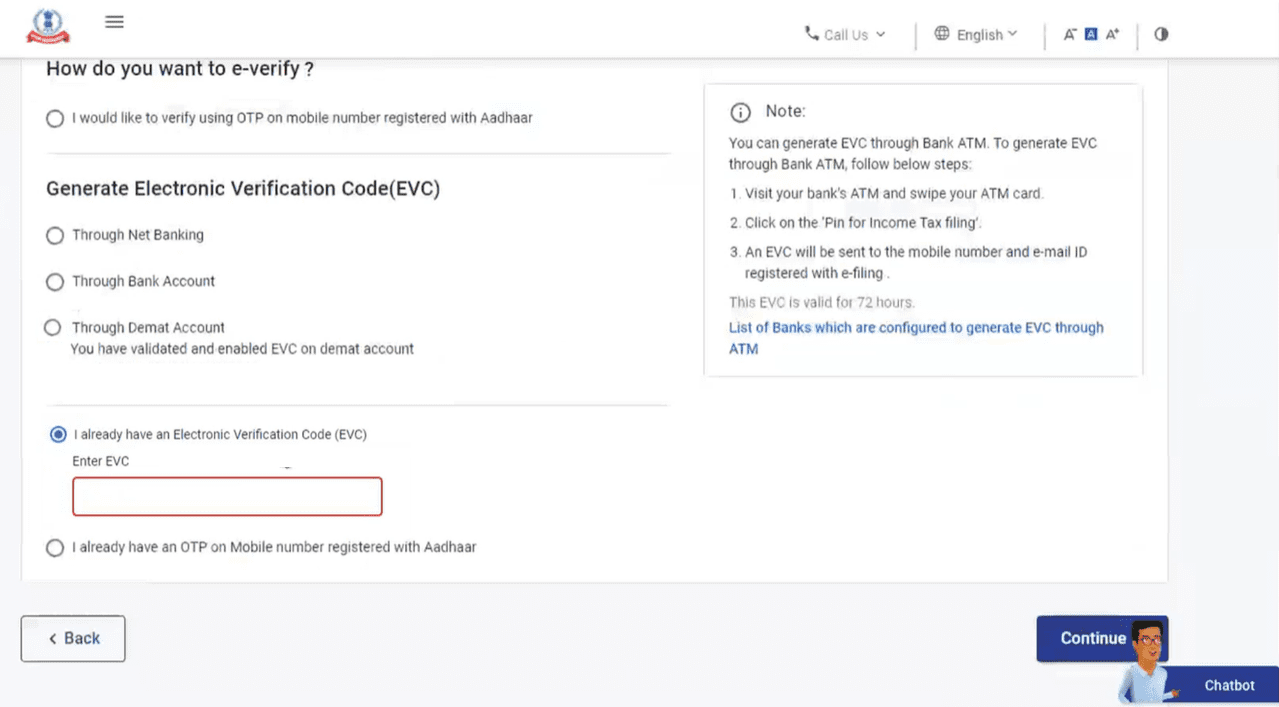

The process of e-verification using an existing verification code or EVC involves only two steps. They are mentioned below -

STEP-1: Select the option ‘I already have an Electronic Verification Code (EVC)’, on the e-Verify page.

STEP-2: Enter the EVC that you have in the ‘Enter EVC’ textbox and click on ‘Continue’.

You will receive a success message along with a Transaction ID and EVC on the screen. You will also receive confirmation messages on the email ID and mobile number that is registered on the e-Filing portal.

Don’t forget to take a note of the Transaction ID and EVC for future reference.

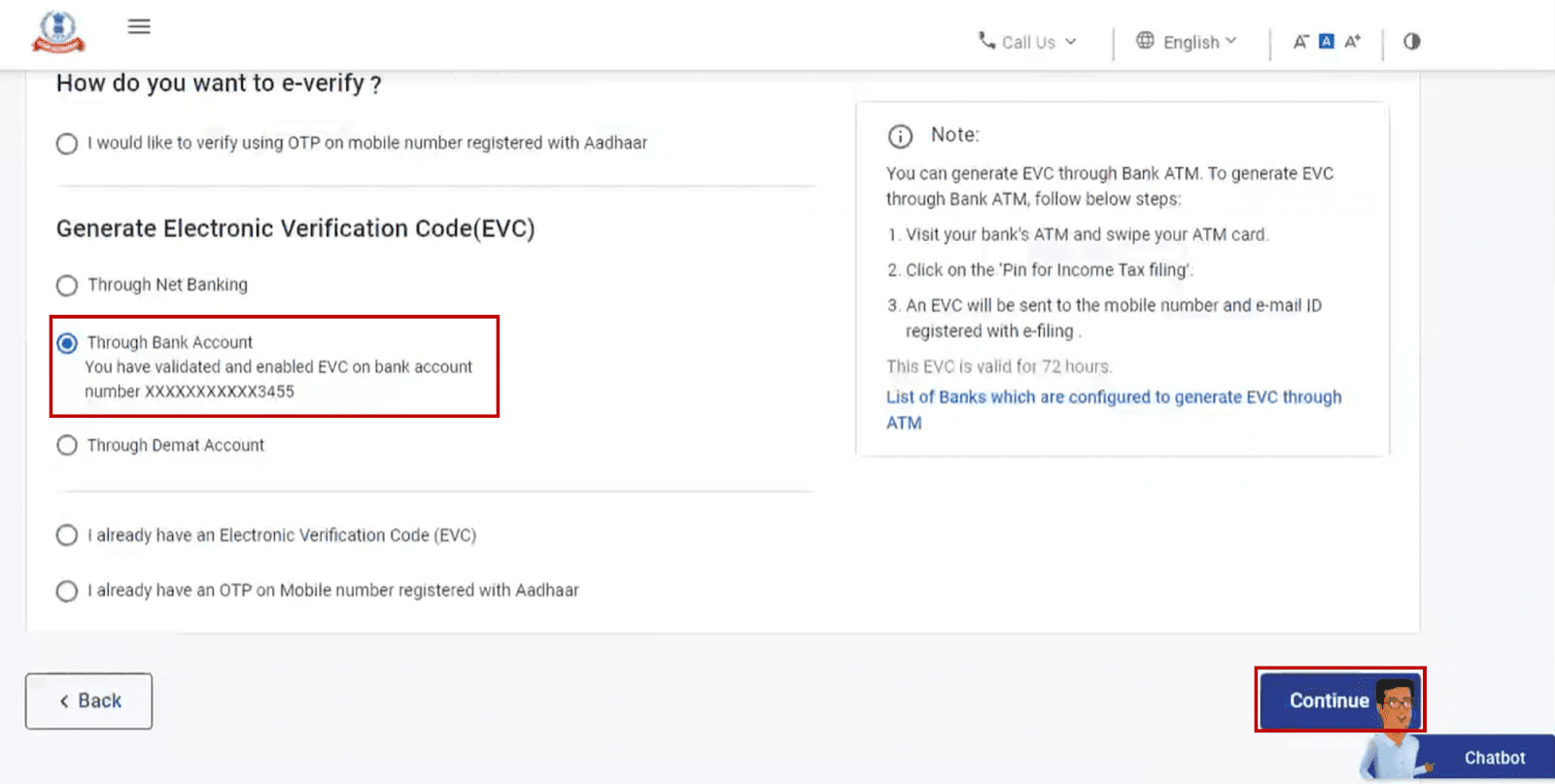

The process of e-verification after generation of an EVC through your bank account is pretty straightforward. Take a look at the steps below -

STEP-1: When you are on the e-Verify page, choose the option ‘Through Bank Account’ under the ‘Generate Electronic Verification Code (EVC)’ section. Click on ‘Continue’.

STEP-3: You will receive the generated EVC on your mobile number and email ID that is registered with your pre-validated and EVC enabled bank account.

STEP-4: Enter the EVC that you have received in the ‘Enter EVC’ textbox.

STEP-5: Finally click on the ‘e-Verify’ button towards the right side bottom of the screen.

After completion of the process, a success message along with a Transaction ID and EVC will be displayed on the screen. Remember to take a note of the Transaction ID and EVC for future reference. You will also receive confirmation messages on your registered email ID and mobile number.

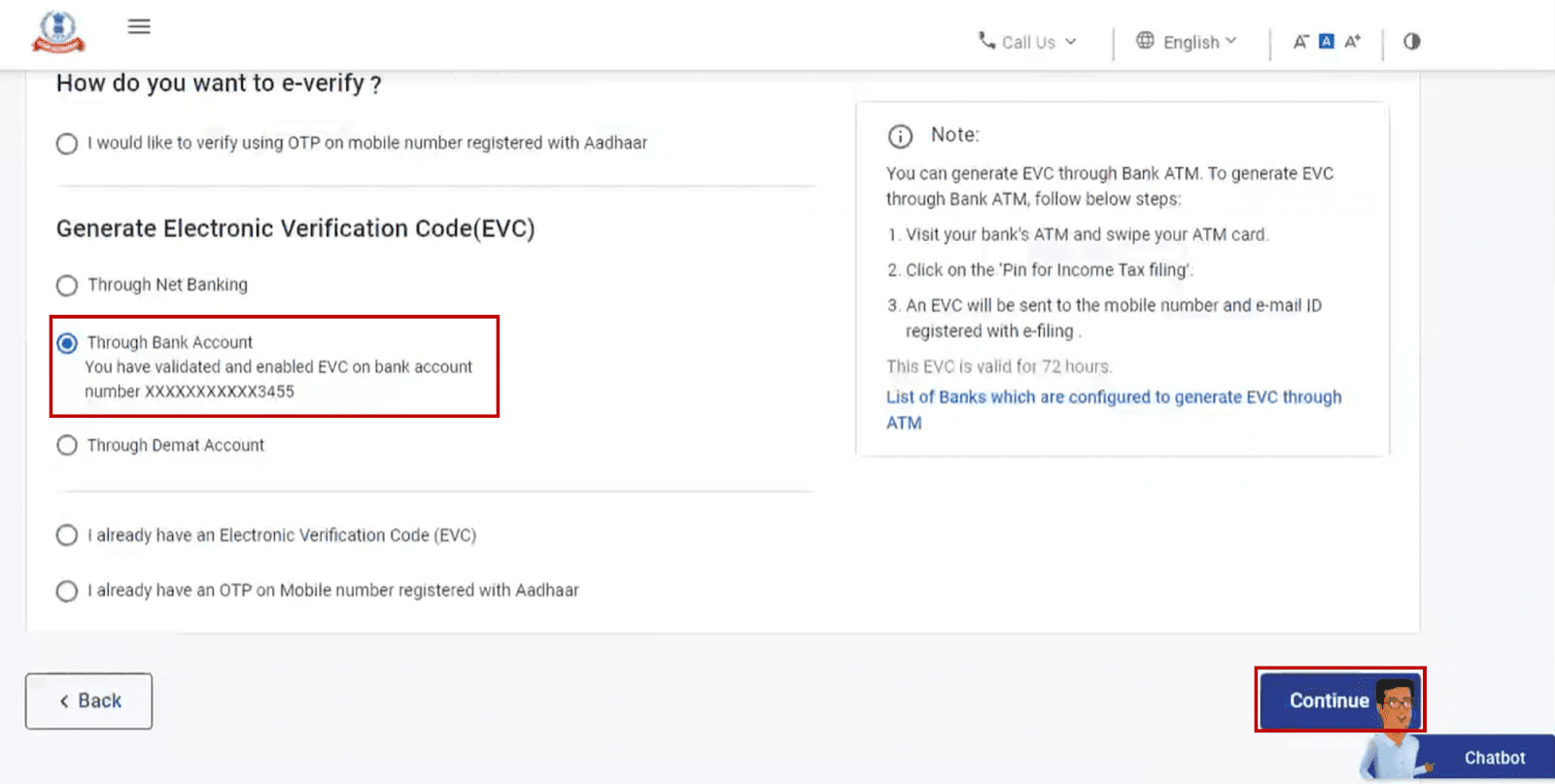

Want to know how to e-verify income tax return after generating an EVC through your Demat account? Just follow these steps -

STEP-1: Once you are on the e-Verify page, select the ‘Through Demat Account’ option. You will find it under the ‘Generate Electronic Verification Code (EVC)’ section.

Click on ‘Continue’.

STEP-3: Once the EVC is generated, you will receive it on your mobile number and email ID that is already registered with your pre-validated and EVC-enabled demat account.

STEP-4: Enter the EVC in the ‘Enter EVC’ textbox and click on ‘e-Verify’.

You will be able to see a success message page containing a Transaction ID and EVC. Take note of the Transaction ID and EVC for future reference. You will also receive confirmation messages on the email ID and mobile number that is registered on the e-Filing portal.

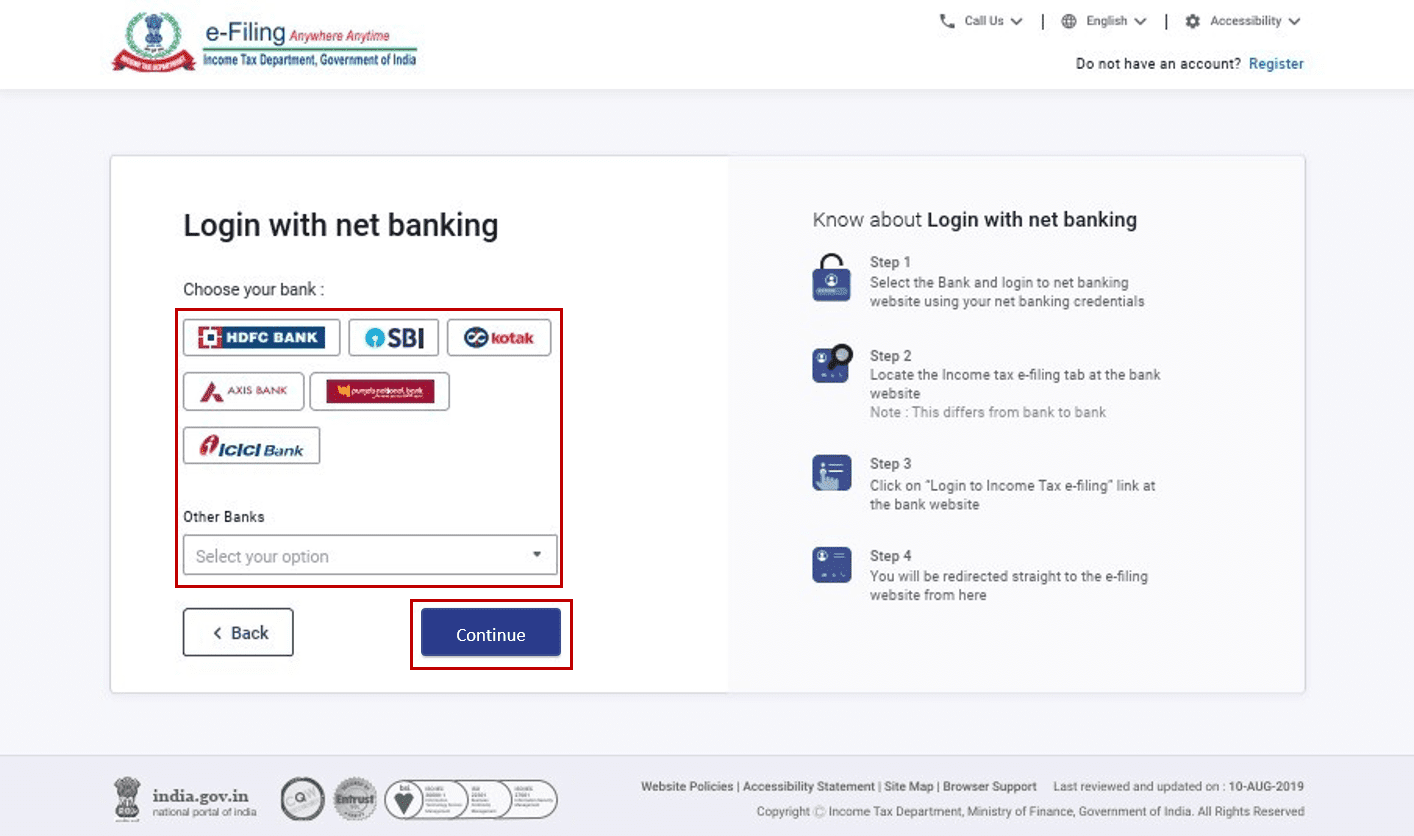

You can easily e-verify your ITR using Net Banking as well. To do so, follow these steps -

STEP-1: On the e-Verify page, select ‘Through Net Banking’ from the ‘Generate electronic verification code (EVC)’ section. Then, click on ‘Continue’.

STEP-2: Choose your bank on the ‘Login with net banking’ screen, and click on ‘Continue’.

STEP-3: A disclaimer will pop-up on the screen. Click on ‘Continue’ once you have read and understood it.

STEP-4: You will be redirected to the Net Banking login page of your bank, where you must login using your credentials.

STEP-5: Click on the link to log in to e-Filing from your bank's website. You will be logged out of your bank website, and logged in to the e-Filing portal.

STEP-6: If the login was successful, you will find yourself on the e-Filing Dashboard. Go to the ‘ITR’ option and click on ‘e-Verify’.

With this, your ITR will be successfully e-verified and you will see a success message and a Transaction ID. Please note the Transaction ID for future reference. A confirmation message will also be sent to your email ID and mobile number.

How to Change Mobile Number in Aadhar Online

How to Check Aadhaar Card Link with Mobile Number

How to Download Aadhar card Download without Mobile Number

How to Change Date of Birth in Aadhar Card

How to Change Mobile Number in Aadhar without OTP

How to Link EPF Account with Aadhar

Income Tax Aadhar Link

Aadhar Bank Link

Link Aadhaar with Mobile Number

Pan Aadhaar Link

Link Voter ID with Aadhaar Card

Link UAN with Aadhaar Card

Ration Card Aadhar Link

Download E-Aadhaar Card

e-Verifying your ITR is incredibly important. Not only will you get your refunds if you are eligible for it but your ITR process will only be complete after the e-verification.

In case a few days have passed since you filed your ITR, you can still e-verify your returns. Click here to find out how.

Was this information useful?