2 Jan 2026

Unlike in the past, loan approvals today happen in seconds. One integral part of these instant loans is the submission of a PAN card for identification. This article will discuss how to check all your loan details in various ways.

PAN cards have been the subject of several frauds in recent times. To ensure the safety of your credentials and avoid unnecessary loans in your name, you must regularly check the active loans on your PAN card. You can do so by checking your credit report.

The credit report is a summary of your credit history, and it is mapped to your PAN card. The report summarizes your credit score and also allows you to check all your loans.

|

Check active loans on your PAN card using CIBIL |

|

|

Check active loans on your PAN card using Experian |

|

|

Check active loans on your PAN card using Equifax |

|

|

Check active loans on your PAN card using CRIF |

CIBIL and Experian are the major credit bureaus operating in India. Banks and lending institutions seek credit reports from these bureaus to check your creditworthiness and ensure a safe financial transaction.

CIBIL and Experian also provide credit reports to individuals seeking them. The reports contain detailed information about your loan history, an overview of your job profile, repayment history, credit inquiries, personal and contact information, credit card utilization, and credit score.

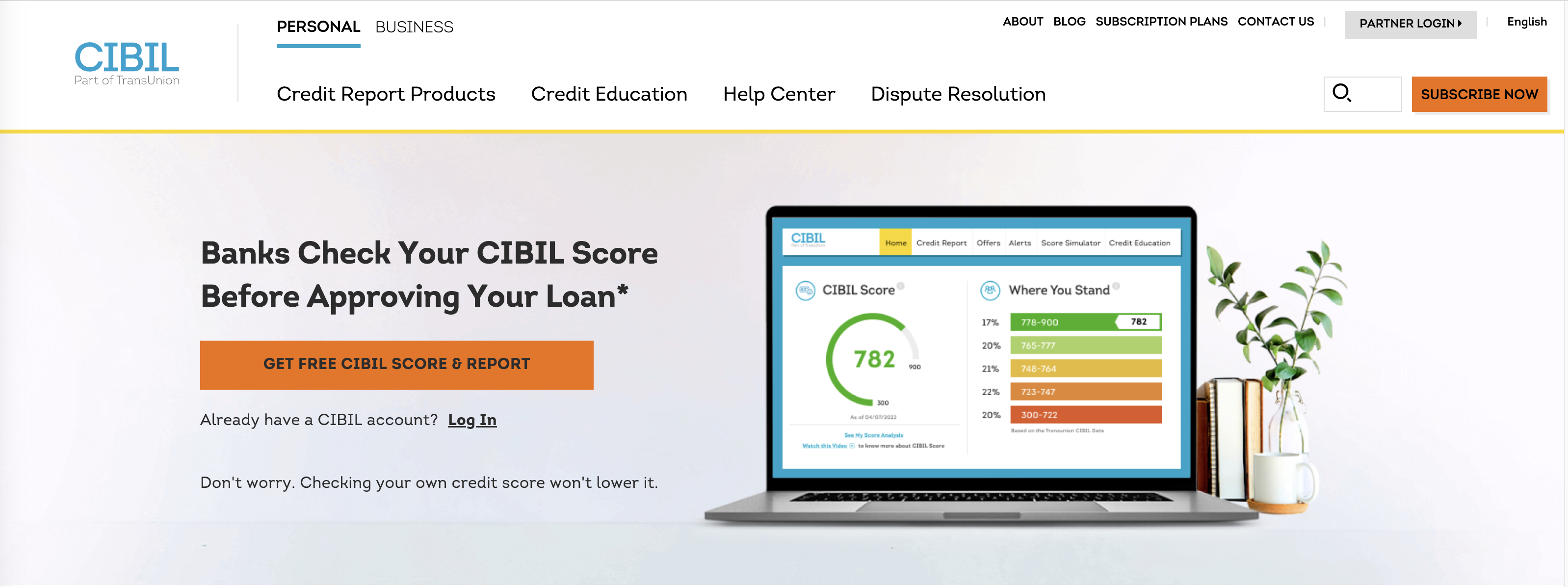

To check your CIBIL score, follow the following steps:

Visit the official website of CIBIL

Click on “Get Free CIBIL Score & Report.”

Create an account if you are a new user by "entering your personal information", including your name, identity proof (PAN Card and PAN Card number), and date of birth, and press continue

On the next screen, "enter the OTP sent to your mobile number and email address" for verification

The page will be directed to the main dashboard of your CIBIL account

On your dashboard, you will find your CIBIL score along with information regarding your employment, account, and more. CIBIL also allows you to analyse your score and download the report free of cost.

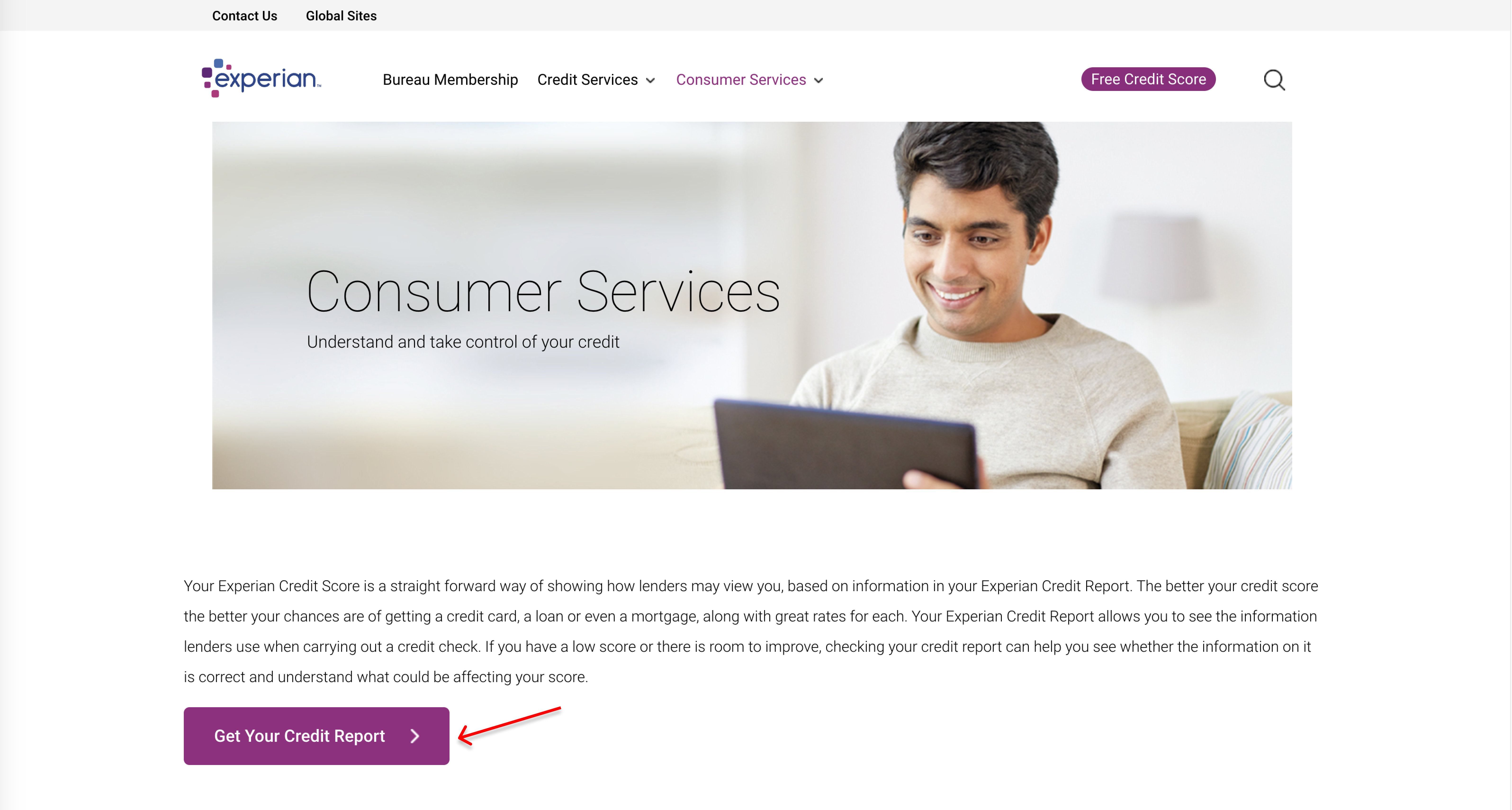

You can find out your Experian score in the following way:

On the Experian website, click on “Get your Credit Report”

Provide your mobile number on the next page and "enter the OTP" sent

On the next screen, enter the details linked to your loan or credit card account (name, email address, DOB, PAN card number, address, and PIN code)

Then, agree to the terms and conditions of Experian and click on “Get Report”

The report gives a detailed insight into your loans and the factors that play a role in determining the score.

CIBIL and Experian also allow users to raise a dispute in case of any discrepancies in the credit report.

There are also several third-party applications that provide your credit score instantly. Most applications display both CIBIL and Experian scores in one place, making it easier for users.

While it is quicker, you must be wary of possible illegal websites that might use your information for fraudulent activities.

Equifax is a credit bureau that provides credit reports and scores based on an individual's credit history. Usually, you can access your credit report for free once a year.

If you are searching for ‘how to check my all loan details’ through Equifax, follow these steps -

Visit the Equifax website

Create an account if you are a new user or login if you're an existing user

Provide personal details such as your name, address, PAN card number, DOB, etc

You can then request a credit report containing your credit history, including loans and credit accounts

The credit report will show information about your loans, including their status, outstanding balances, payment history, and other relevant details

Remember, Equifax provides credit reports based on your credit history, which may not be directly linked to your PAN card. Your credit report will contain information based on the accounts and loans that are associated with your name, address, and other personal details you provide to financial institutions.

CRIF High Mark doesn't offer a direct way to check active loans using only your PAN card. However, you can access your credit report from CRIF High Mark, which will list all your current and past loans along with their details like outstanding balances, repayment history, and credit limits. Here's how you can do it.

Visit the CRIF High Mark website

Fill in your details such as your full name, mobile number, email ID, ID proof, and address.

You will have to provide any 1 ID proof out of PA, Voter’s ID, Passport number, driving license, or Ration card.

Next, select your report type from the three available options: Free Credit Report, Paid Report (via Subscription Plans), and Paid Report (without a score).

On the next page, you will be asked to authenticate your identity by answering a few questions based on your credit history

After answering one of these three questions correctly, you will be given your report via your registered email ID and the account dashboard.

PAN cards mainly serve as tax identification documents, and lenders typically require additional information for verification to access your loan details. Learn how to check all your loan details using your PAN card along with other information -

This is often the quickest and most convenient option. Most lenders offer platforms where you can log in with your credentials and view your active loans. Here are the steps to follow -

Sign up using your KYC details like your bank account information and PAN.

Confirm your credentials and log into your account.

Go to the ‘Loans’ section to check the active loans on your PAN. You can manage and review each loan.

Some lenders allow you to view active loans on their website without logging into online banking. You might need to register or create an account with your PAN card and other details.

Call or email the lender and inquire about your active loans. Provide your PAN card number, name, or loan account number for verification. This might be helpful if you don't have online access.

Review your most recent paper statements from each lender. These typically include details about your current loan balance, payment due date, and interest rate.

Here are some important reasons why you should track your active loans on your PAN card:

1. Tracking active loans helps in maintaining your credit health by allowing you to make informed decisions on taking further loans.

2. By tracking active loans on your PAN card, you can prevent fraud. If you notice any unauthorised loans under your name, you can take action by informing the authorities.

3. You can effectively manage your budget by keeping track of your active loans. This way, you can ensure a healthy debt-to-income ratio.

4. Tracking your loans also helps in making sure that you comply with tax regulations. This can prevent any legal complications due to unpaid or misreported loans.

If you want to know how to stop the misuse of your PAN card, then you need to keep an eye on the activities that involve your PAN card. PAN card misuse has become a common problem in recent years.

Users must stay vigilant and avoid sharing personal information regarding the PAN on suspicious websites. If your PAN is active but the details are not as per PAN, then immediately raise a complaint. Check your credit report regularly to see if there are any loans under your name that you are not aware of.

Best Personal Loan Resources

Personal Loan by Income and Purpose

Personal Loan in Top Cities

Loan EMI Calculators

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?