About Bank of Baroda

Established in 1908, the Bank of Baroda is a state-owned international bank. It was nationalized in 1969 and has a total of 8,220 domestic branches.

Steps to Apply for a Personal Loan

1

Create an account or log in using your credentials on the bank or NBFC's website.

2

Check your eligibility and upload your documents.

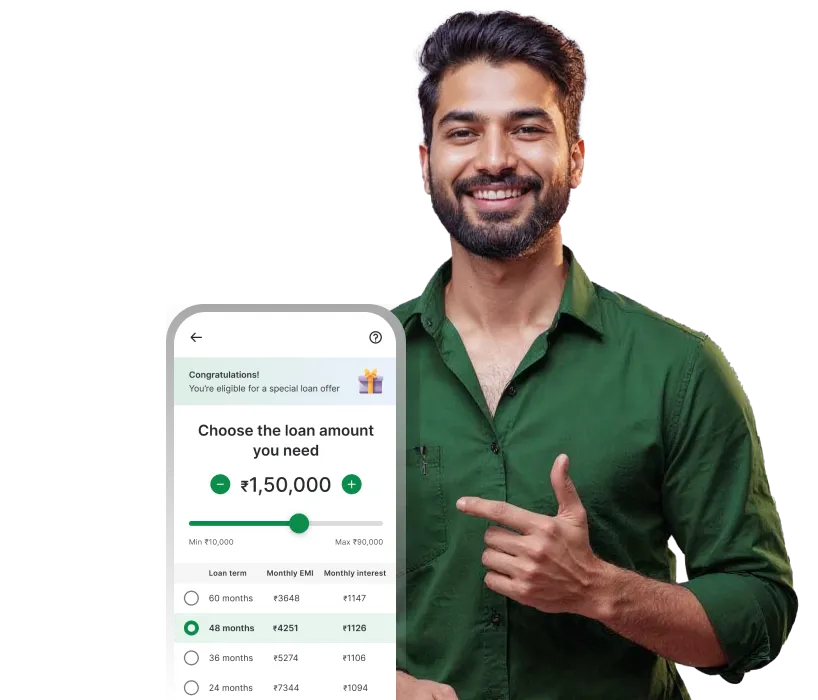

3

Enter the loan amount and select the tenure from the options provided.

4

Click the 'Apply Now' button to apply!

Factors Affecting Bank of Baroda Personal Loan EMI

Rate of interest

Your creditworthiness

Your loan amount

Your location (urban or rural)

Conclusion

Calculating your EMI before applying for a loan helps you plan your budget. You can use Moneyview's Bank of Baroda personal loan EMI calculator to know your EMI with just a few clicks. For urgent fund requirements, consider Moneyview's instant personal loans. They get disbursed within 24 hours in most cases.

Bank of Baroda Calculator - Related FAQs

How much interest rate does the Bank of Baroda charge on personal loans?

Can I apply for a Bank of Baroda personal loan online?

Interlinks

Popular Bank Loan EMI Calculators

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.