About Punjab National Bank

Established in May 1984, Punjab National Bank, or PNB is a public sector bank headquartered in Delhi. PNB has over 180 million customers, 12,248 branches, and 13,000+ ATMs across India.

Steps to Apply for a Personal Loan

1

Log into the lender's app or website using your mobile number or email ID.

2

Find the personal loan section, enter your details, and check your eligibility.

3

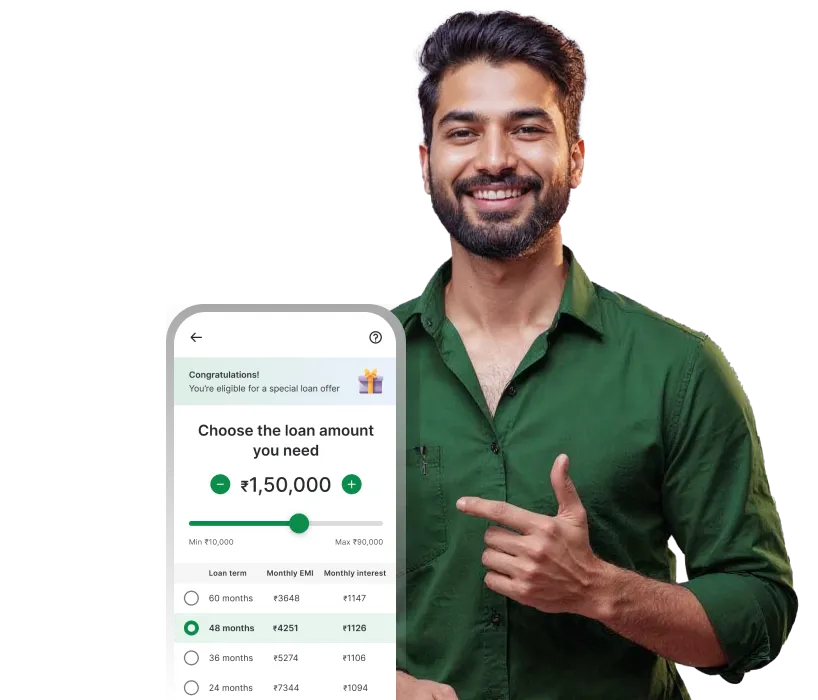

Upload your documents and enter the loan amount.

4

Choose your tenure and click on 'Apply Now'.

Factors Affecting PNB Personal Loan EMI

Credit score of the applicant

Age of the applicant

Tenure selected by the applicant

Loan amount applied for by the applicant

Conclusion

Checking your EMI before applying for a loan gives an idea of the EMIs you must pay. That helps you plan ahead of time and pay off the loan without stress. Moneyview's PNB personal loan EMI calculator brings the calculation of EMIs to your fingertips. To apply for instant personal loans, head over to the Moneyview app.

PNB Personal Loan EMI Calculator - Related FAQs

What is the interest rate for a PNB Rs.3 Lakh personal loan?

How to use the Moneyview PNB personal loan EMI calculator?

Interlinks

Popular Bank Loan EMI Calculators

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.