About State Bank of India (SBI)

The State Bank of India or SBI, is an Indian multinational public sector bank that offers diversified financial services to all Indians. SBI continues to revolutionize banking in India, aiming to provide responsible and sustainable banking solutions.

Steps to Apply for a Home Loan

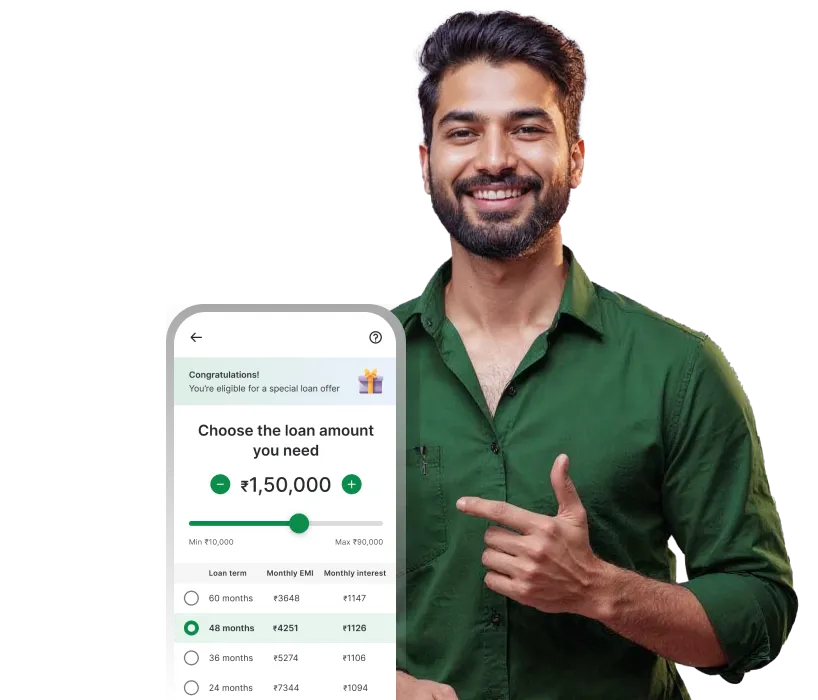

1

Through the lender's website or the app, go to the loans section and select the home loan option

2

Provide your date of birth, income, details of other loans, and check your eligibility for the loan

3

Check your eligible loan amount and then select the tenure

4

Submit the application to initiate the loan approval process

Factors Affecting SBI Bank Home Loan EMI

Type of Interest

Loan-to-Value (LTV) Ratio

Credit Score

Location of the Property

Job Profile

Tenure of the Loan

Conclusion

Home loan is a huge responsibility. Hence, it is crucial to calculate all the costs involved such as EMI, before taking it. With Moneyview's SBI home loan EMI calculator, you can find out your EMI in mere seconds. Take control of your finances today with our SBI bank home loan EMI calculator.

SBI Home Loan EMI Calculator - Related FAQs

What is the current interest rate of an SBI home loan?

As per the information provided on the SBI website, the interest for a regular home loan currently starts at 9.15%. SBI offers different types of home loans, hence contact the bank directly to understand your home loan interest rates.

How much EMI should I pay for a Rs. 20 Lakh home loan in SBI?

Your EMI depends on various factors such as tenure, interest rate, and more. Use Moneyview's SBI bank home loan EMI calculator to accurately calculate your EMI.

Interlinks

Popular Bank Loan EMI Calculators

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.