About SBI Bank Personal Loan

State Bank of India (SBI) is an Indian multinational Fortune 500 company and the largest Indian bank serving over 48 crore customers through diversified businesses and its various subsidiaries.

Steps to Apply for a Personal Loan

1

Visit Moneyview website and log in using with your mobile number

2

Check your eligibility and upload the required documents

3

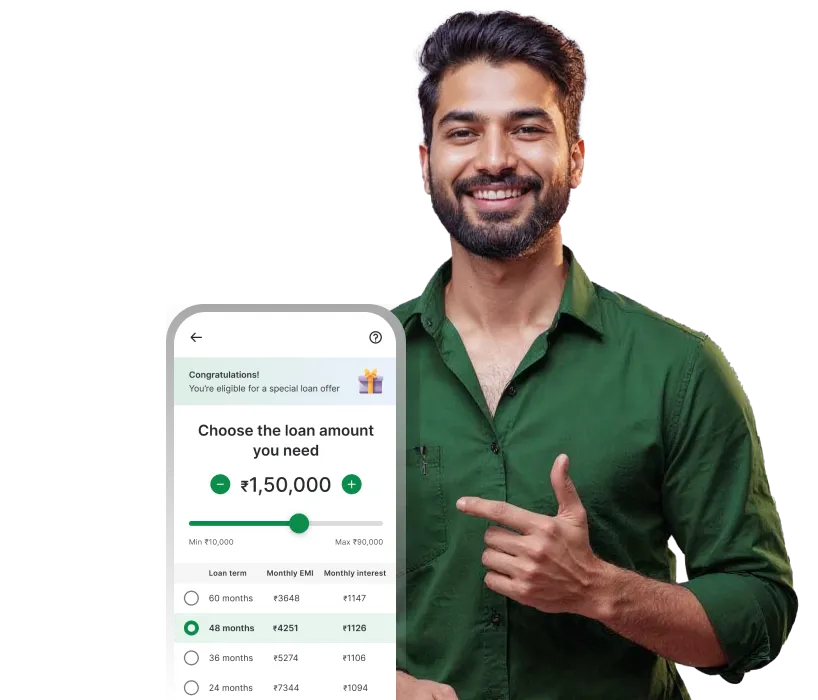

Next, choose your loan amount and the desired tenure

4

Submit the application and wait for the lender to get back to you post-verification

Factors Affecting SBI Bank Personal Loan EMI

Your credit score

Loan tenure

Interest rate

Borrower profile

Conclusion

Calculating your EMI for your personal loan has become much easier! With a few clicks, you can plan your future finances in minutes. For appealing personal loans and affordable interest rates, apply for a loan today from Moneyview!

SBI Bank Personal Loan EMI Related FAQs

What is the interest rate for SBI Bank personal loans?

SBI offers personal loans at an interest rate starting from 11.40%.

Is the SBI personal loan calculator free to use?

Yes. Moneyview's SBI personal loan EMI calculator is free to use for all and there is no limit on the number of times you can use it.

Interlinks

Popular Bank Loan EMI Calculators

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.