About HDFC Bank Personal Loan

HDFC Bank, one of India's most trusted banks, began its operations in 1994 and now has a distribution network of 8,086 branches across 3,836 cities. Customers in India are served through a variety of channels of delivery, including phone banking, internet banking, mobile banking, and SMS-based banking.

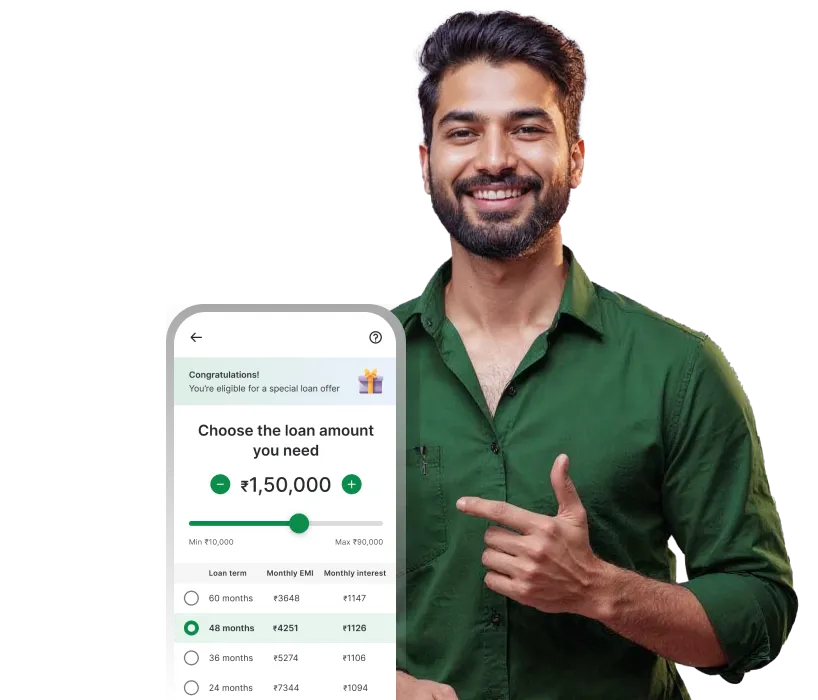

Steps to Apply for a Personal Loan

1

Go to the lender's website and create an account, or log in using your credentials if you are already a customer

2

Using their eligibility checker, find out the loan amount you are eligible for

3

Select a loan plan and a tenure that suits your requirements

4

Upload all the necessary documents like ID proof, address proof, and income proof

5

Next, click on 'Submit' to complete the application

Factors Affecting HDFC Bank Personal Loan EMI

Credit score

Income

Employment history

Debt to income ratio

Age

Conclusion

Before applying for a loan, figure out your EMI to help you with budgeting. With a few clicks, you can find out your EMI with Moneyview's HDFC personal loan calculator. Moneyview offers quick personal loans for those with immediate financial needs. Apply today and get your loan in minutes!

HDFC Bank Personal Loan EMI Related FAQs

What is the Interest rate of HDFC Personal Loans?

HDFC personal loan interest rates range from 10.50% p.a. to 24.00% per annum.

Can I get a 50,000 loan from HDFC without a salary slip?

No. Borrowers must submit their salary slips as proof of income to obtain a loan from HDFC.

Interlinks

Popular Bank Loan EMI Calculators

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.