About ICICI Bank Personal Loan

ICICI Bank provides a diverse range of banking products and financial services to corporate and retail customers via various delivery channels and through its group companies.

Steps to Apply for a Moneyview Personal Loan

1

Go to your Moneyview's website and log in using your credentials

2

Check your eligibility and the amount of loan you can avail

3

Next, upload the scanned copies of the documents

4

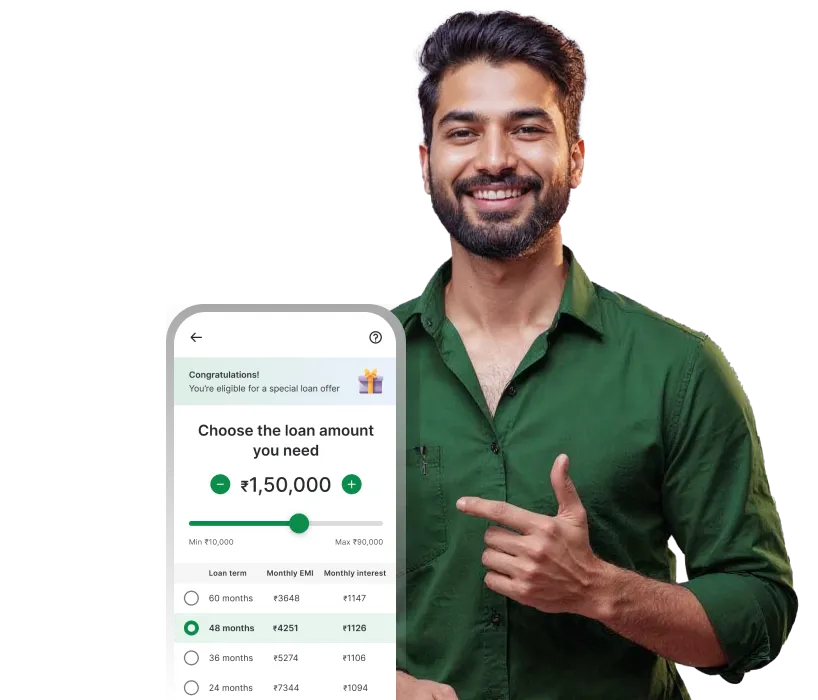

Select the loan amount and tenure that you are comfortable with

5

Click on 'Apply Now' to submit your application

Factors Affecting ICICI Bank Personal Loan EMI

Loan amount

The interest rate of the bank

Credit score

Loan tenure

Previous relationship with the bank

Conclusion

Personal loan EMI calculator allows you to instantly check your EMIs and understand how to plan your finances easily. Using this you can take a loan that fits your situation. To take a personal loan, apply with Moneyview, an instant online personal loan provider, offering any amount from Rs. 5000 to Rs. 10 Lakh within minutes.

ICICI Bank Personal Loan EMI Related FAQs

What is the interest rate for ICICI Bank personal loans?

Interest rates of ICICI Bank's personal loans start from 10.80% onwards.

How much personal loan can I get from ICICI Bank?

Depending on your salary, credit score, and career, you can obtain a Personal Loan ranging from Rs 50,000 to Rs 50 lakh, as per ICICI Bank's internal policies. The amount is determined based on your age, income, and other variables.

Interlinks

Popular Bank Loan EMI Calculators

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.