About ICICI Bank

ICICI Bank was established on 5th January 1994 and is one of the top private sector banks in India. It also has a presence in over 17 countries. ICICI Bank has approximately 5,900 branches and 16,650 ATMs spread all over the country.

Steps to Apply for a Home Loan

1

Log in to the lender's website or download their app and create an account.

2

Once logged in, go to the home loan section and check your eligibility.

3

Upload the required documents mentioned. The requirements may vary depending on the bank.

4

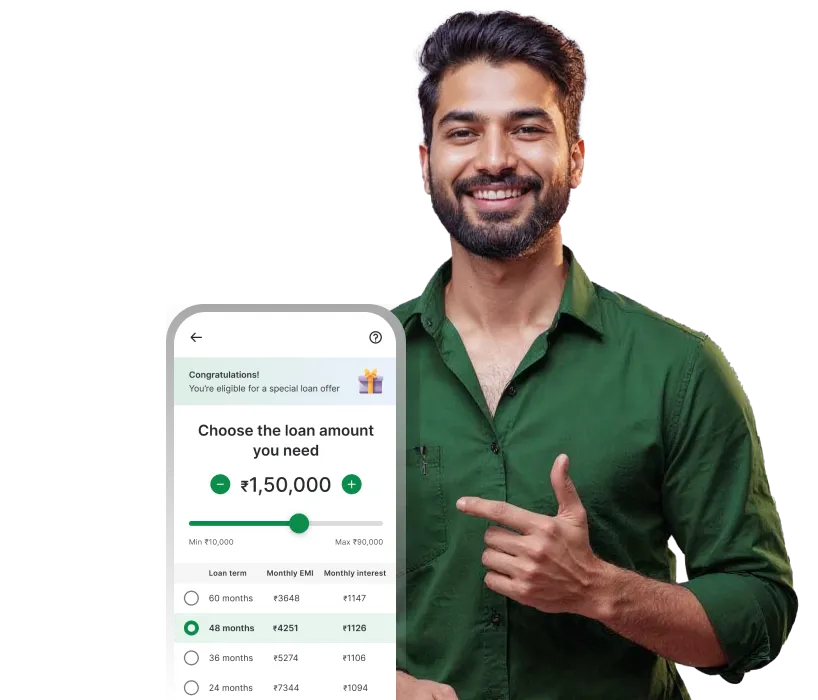

Enter your loan amount and tenure and click on 'Apply Now' to initiate the application process.

Factors Affecting ICICI Bank Home Loan EMI

The interest rate offered by the bank

Your prior relationship with the bank

Valuation of the property that you want to finance

Your credit score and credit report

The downpayment amount

Conclusion

Moneyview's ICICI Bank home loan EMI calculator aids in calculating your EMI amount with just a few clicks. Once you are sure about your tenure and interest rate, it calculates EMIs with accuracy and speed. To get urgent funds, head over to Moneyview's website or download the app and check your eligibility in 2 minutes.

ICICI Home Loan EMI Calculator - Related FAQs

What is the current interest rate of an ICICI home loan?

According to the ICICI website, the most recent interest rates are 9.00% to 9.10%. You can get in touch with the bank to know the interest rates for your case.

How much home loan can I get on a salary of Rs.20,000?

The amount of loan you can get depends on many factors and not just your salary. Your credit score, debt-to-income ratio, and your property valuation will factor in when deciding the loan amount you can get.

Interlinks

Popular Bank Loan EMI Calculators

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.