About HDFC Bank

HDFC is an Indian banking and financial services company established in 1994 and headquartered in Mumbai. It offers various retail and wholesale banking services across India.

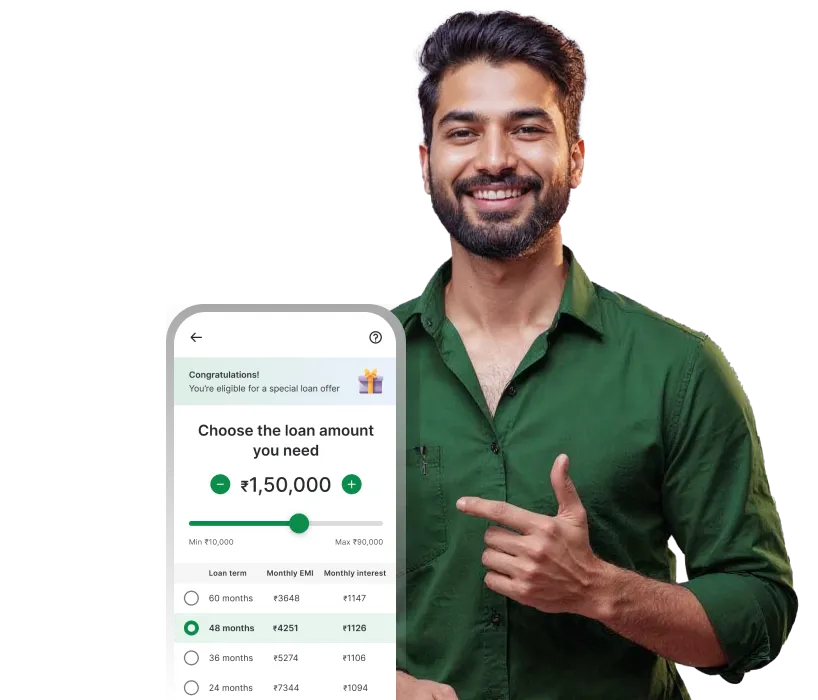

Steps to Apply for a Home Loan

1

On the lender's website, choose 'Apply for home loan'

2

Next, check your eligible loan amount by providing a few basic details

3

After that, select a suitable loan and tenure plan, and upload all your documents

4

Pay the application processing fee and click 'Submit' to complete the process

Factors Affecting HDFC Bank Home Loan EMI

Employment status

Income

CIBIL score

Repayment capacity

Salaried or self-employed

Nationality of the Borrower

Conclusion

Home loan comes with various costs involved, one of which is the monthly EMI. Moneyview's HDFC home loan EMI calculator allows you to plan your finances early by accurately calculating the EMI you have to pay every month. Take control of your finances today with our HDFC bank home loan EMI calculator.

HDFC Bank Home Loan EMI Related FAQs

What is the current interest rate of an HDFC home loan?

Currently, HDFC home loan interest rates start at 8.60%. HDFC home loan interest rates vary depending on your gender, type of employment, and loan amount.

Can I apply for an HDFC home loan online?

Yes. You can easily apply for HDFC home loans online through their website or mobile banking application.

Interlinks

Popular Bank Loan EMI Calculators

Personal loan related links

Loan on Aadhaar & PAN Card

Personal Loan Interest Rates

Personal Loan Eligibility

Personal Loan Documents

Personal Loan For Self-Employed

Personal Loan for Salaried Employees

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.