13 February 2026

Employees’ Provident Fund is an essential part of an employee’s retirement kit. We will talk about all you need to know about the EPF, the contribution needed, the rules for withdrawal, etc.

You need your UAN to check your EPF account balance, withdraw money, apply for loans against your PF, or access any other services. In this article, we will talk all about the UAN activation process.

News Update

Now employees can also update their “date of exit” from an organisation on the EPFO portal, which will smooth the process of EPF claim.

Previously, only employers could update it, which would slow the process in case of errors. To be able to update it seamlessly, your UAN should be active, and you should be able to log in to your EPFO Member e-Seva Portal. Your Aadhaar and mobile number must also be linked.

- As reported by Times Nowon 1 December 2025

UAN or Universal Account Number is a 12 digit number provided by the Employees’ Provident Fund Organisation to all the employees who subscribe to EPF. With this number, an employee can easily do all transactions relating to the EPF on the EPFO website or through the UMANG App of the Government.

People change multiple jobs during their professional careers. But, the UAN or the Universal Account Number remains the same throughout. That becomes the connecting factor between your PF accounts.

When you change a job, you can give your UAN to your new employer and then the new PF contribution can be added to the same account. This makes the process of maintaining a PF account much simpler.

It makes it easier for both you and the employer to track your account and check it.

Your UAN has to be activated before you can make any transactions on the site. You need to keep your UAN and the PF member ID handy before logging into the UAN activation portal.

The UAN activation process is mentioned below in detail -

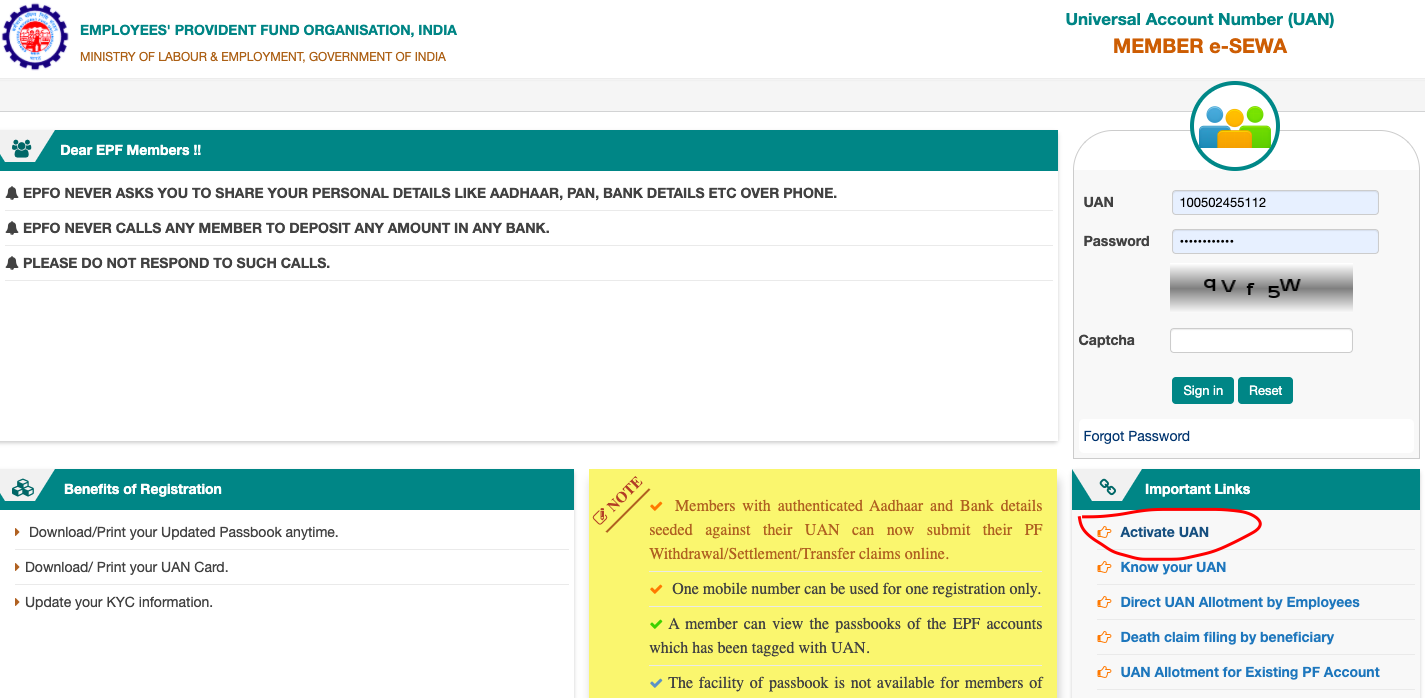

Step 1: Visit the EPFO website and select the For Employees tab from the Services Drop Down menu.

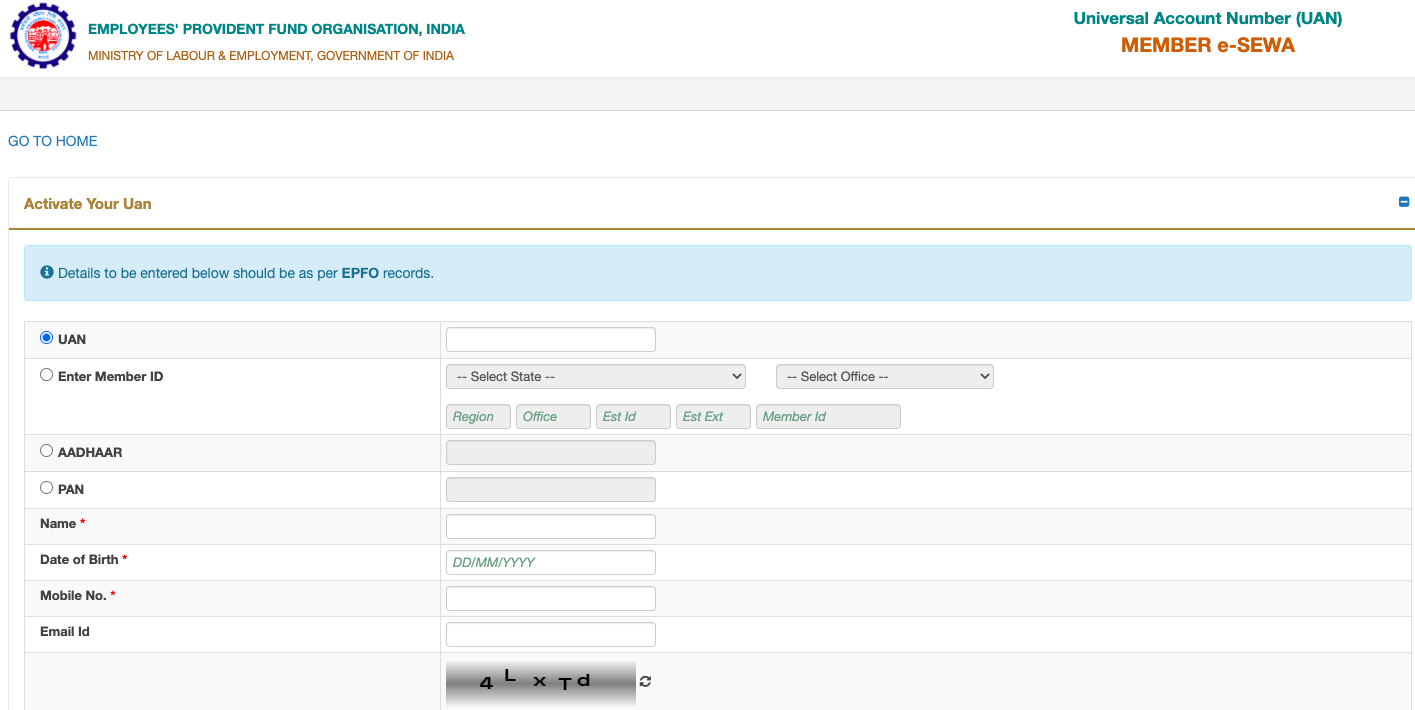

Step 2: On the next page, enter any of the requested information - UAN, Member ID, Aadhaar, or PAN. Enter your name, mobile number, date of birth, and email ID. Enter the Captcha and click on ‘Get Authorization Pin’.

Step 3: You will receive a PIN on your registered mobile number. Select the tickbox beside ‘I Agree’, enter the OTP, and click on ‘Validate OTP and Activate UAN’.

Step 4: Once the UAN is activated, you will receive a password to log in. After logging in you can change your password or do other transactions on the site.

Step 5: Validation and Activation of UAN

You will then receive an OTP on your registered mobile number. Enter the OTP received on the website and click on the “I Agree Back” button. Then, click on ‘Validate OTP and Activate UAN’ to activate your UAN. Once the UAN is activated, you would receive a password for you to log in. After logging in you can change your password or do other transactions on the site.

UAN activation is a very simple process and very few documents are needed. It is generally activated when you start your career and a PF account is created. These are the documents required -

Your Aadhaar card and number

Your valid PAN card

Your Bank account details and IFSC

Any other proof of identity or address, if required

Now that you know how to complete the UAN activation process, what do you do if you forget your password? Here are the steps to reset your UAN password -

STEP 1: Go to the EPFO portal and click on ‘Forgot Password’ near the login section.

STEP 2: Enter your UAN and the Captcha. Click on ‘Submit’.

STEP 3: Then, enter your details like your name, gender, and date of birth. Click on ‘Verify’.

STEP 4: Enter other details like your Aadhaar number and captcha code. Click on ‘Verify’.

STEP 5: Once your details are validated, provide your mobile number and click on ‘Get OTP’.

STEP 6: You will receive an OTP on the mobile number you entered. Enter the OTP and click on ‘Verify’.

STEP 7: You will now be prompted to change your password. Enter your new password in the boxes. Finally, click on ‘Submit’ to update it on the EPFO portal.

Once you have completed your UAN number activation, you have to link it to your Aadhaar. Follow these steps to link your UAN with Aadhaar -

Step 1: Log in to your EPFO account by visiting the member home page.

Step 2: Go to ‘Manage’ → ‘KYC’.

Step 3: Enter your 12-digit Aadhaar number, and name, and click on ‘Save’.

Step 4: You will be able to see your request in the ‘KYC Pending for Approval’ section.

Step 5: Once your details are confirmed by UIDAI, you will be able to see ‘Verified by UIDAI’ beside your Aadhaar.

EPFO is a single portal that allows you to carry out all the transactions for your PF account. It has several benefits -

You may have different PF accounts but they are all linked through a single number, which is the UAN. When you change your employer, you just need to submit your UAN to your employer and all your PF accounts can be viewed under a single account.

If your Aadhaar and Bank account details are linked to your UAN, you can easily withdraw your EPF balance by submitting claims online.

You can check the status of your claims or the balance in your EPF account on the EPFO portal.

EPFO is a single portal that allows you to carry out all the transactions for your PF account. It is extremely useful to an employee in more than one way.

Some of the ways in which an employee can make the best use of the EFPO portal are:

Activating your UAN is very easy, do it and make the best use of the EFPO portal for your benefit.

Related Aadhaar Articles:

How to Change Mobile Number in Aadhar Online

How to Check Aadhaar Card Link with Mobile Number

How to Download Aadhar card Download without Mobile Number

How to Change Date of Birth in Aadhar Card

How to Change Mobile Number in Aadhar without OTP

How to Link EPF Account with Aadhar

Income Tax Aadhar Link

Aadhar Bank Link

Link Aadhaar with Mobile Number

Pan Aadhaar Link

Link Voter ID with Aadhaar Card

Link UAN with Aadhaar Card

Ration Card Aadhar Link

Download E-Aadhaar Card

The UAN activation process is simple and necessary to make the best use of the EFPO portal for all services. Make sure to have all the necessary information on hand, such as your UAN, mobile number, and member ID, before you begin the UAN activation process.

By following the steps outlined in the UAN activation process, you can access a range of EPF-related services and benefits. If you encounter any issues during the activation process, don't hesitate to contact the EPFO for assistance.

The UAN stands for Universal Account Number, and it is a 12 digit number. It is provided by the Employees’ Provident Fund Organisation to all employees who subscribe to EPF.

Finance and Legal Term Differences

Credit Card Insights

CIBIL Score Check and Boost Guide

Banking & Investment Tips

Finance and Banking Articles

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?