The Employee’s Provident Fund or EPF is a type of financial security that serves as a reliable and controlled investment option for employees' post-retirement needs. Throughout their work, the employee and the employer make PF contributions.

This article will talk about various ways to check your EPF balance.

Checking your EPF balance is very easy and there are many ways to do it. The various ways in which you can check your EPF balance are:

| Method to Check EPF Balance | Number / Link |

|---|---|

|

Missed Call Facility |

9966044425 |

|

SMS Facility |

Send <EPFOHO UAN > to 7738299899 |

|

EPFO Portal |

|

|

UMANG App |

Now we will look at each of these methods in detail.

The missed call number for checking your EPF balance is -

You will receive an SMS containing your PF information after making a missed call.

Here are some points to note before using this service -

You need to call from your registered mobile number

This service is only accessible if your UAN and KYC information have been integrated. If you are unable to accomplish this, you can ask your employer for assistance.

Follow these steps to check your EPF balance using SMS services -

Type EPFOHO UAN on your SMS chatbox.

Send the SMS to 7738299899 in step one.

These are the points you need to notice while using this service -

Your UAN needs to be linked with your KYC information, such as your Aadhaar, or PAN, or bank account information.

You have to send the message from your registered mobile number.

While English is the default language, you can select another language if you want to. Here are the codes you need to send for getting the message in the language of your choice -

| Language | Code |

|---|---|

|

English |

EPFOHO UAN |

|

Hindi |

EPFOHO UAN HIN |

|

Punjabi |

EPFOHO UAN PUN |

|

Gujarati |

EPFOHO UAN GUJ |

|

Marathi |

EPFOHO UAN MAR |

|

Kannada |

EPFOHO UAN KAN |

|

Telugu |

EPFOHO UAN TEL |

|

Tamil |

EPFOHO UAN TAM |

|

Malayalam |

EPFOHO UAN MAL |

|

Bengali |

EPFOHO UAN BEN |

The Employees’ Provident Fund Organisation portal is a one-stop solution for all your EPF transactions, be it learning which forms to fill, submitting a claim, or checking the status of the claim.

Checking your EPF balance can also be easily done on the EPFO portal. The steps involved in checking your EPF balance are as follows -

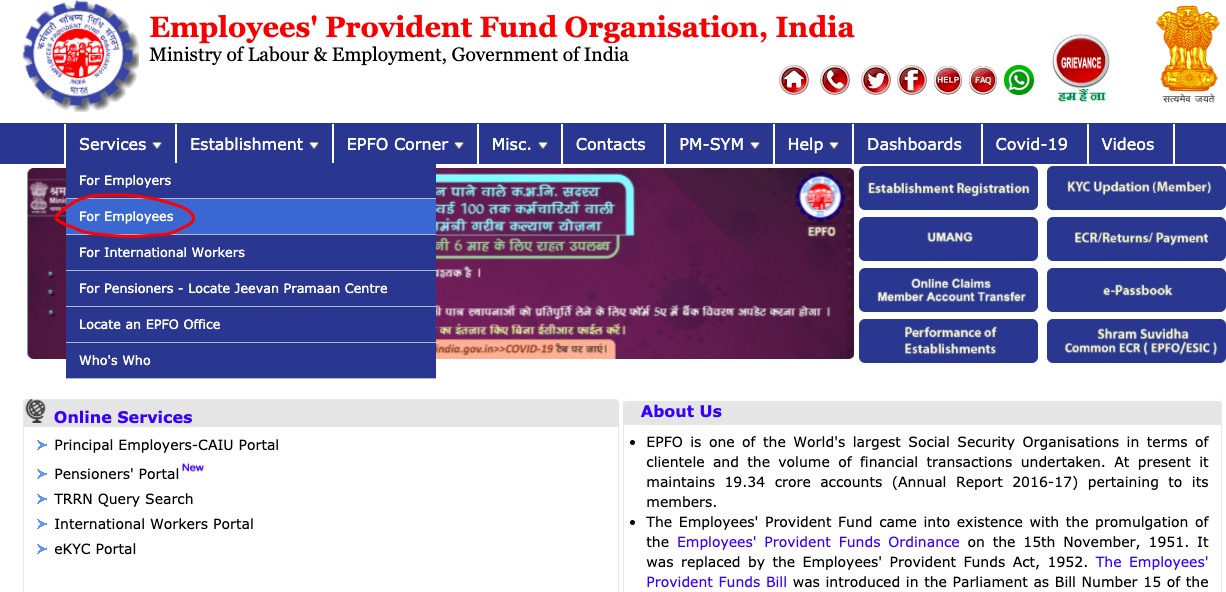

Step 1: On the home page of the portal, click on the ‘For Employees’ tab from the ‘Services’ drop down.

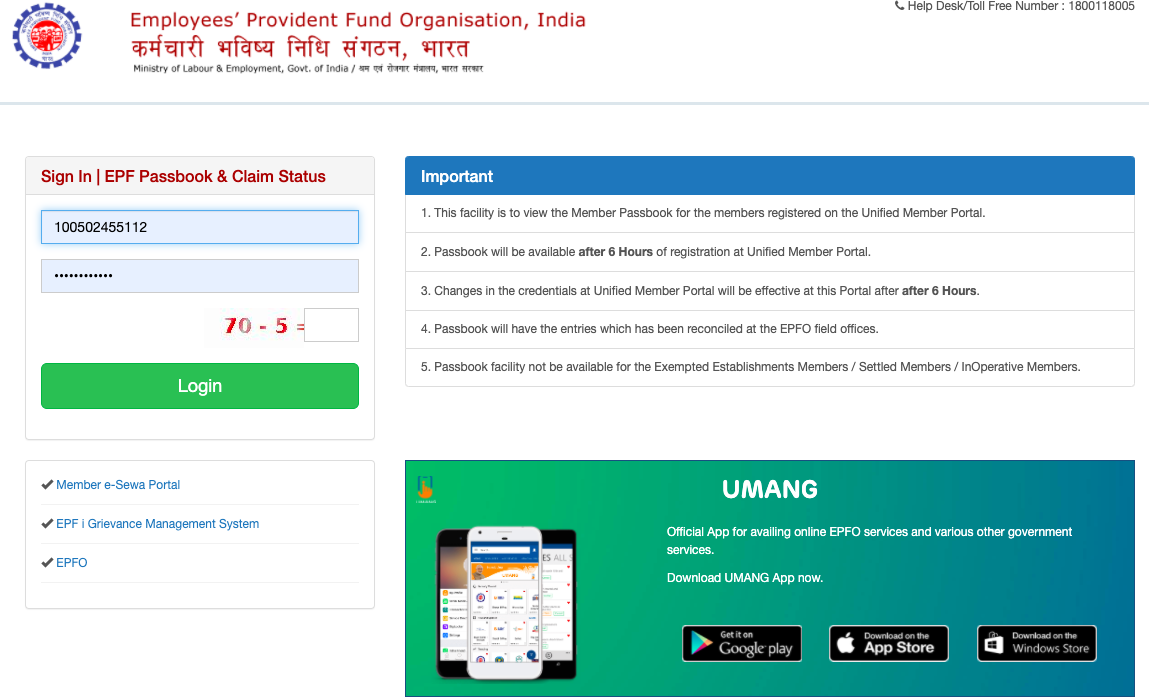

Step 2: Click on ‘Member PassBook’ under Services. You would come on to the page wherein you would need to fill in your UAN and other details. Please note that you will have to activate your UAN before trying to check your EPF account balance. Learn more about how to activate your UAN.

Step 3: Provide your UAN and the password to further check your EPF account balance.

Umang or Unified Mobile Application for New-Age Governance is an app by the Government of India. It is an evolving platform designed for citizens of India to offer them access to the pan-India e-Gov services from the Central, State, Local Bodies, and Agencies of government on app, web, SMS, and IVR channels.

Just with an one-time registration, you can view your PF balance, view claim status, or do many other transactions on the app

The EPF, popularly known as the PF combines payments from both you and your employer. It enables you to save for retirement.

You must be aware of your PF account's balance to effectively plan for retirement. Knowing the amount can help you determine whether or not you need to make more investments and how well your funds are matched to your objectives.

Every member of the EPF has online access to their PF accounts and can perform actions like making a withdrawal or monitoring their EPF balance. The EPFO member portal is easier to use using the Universal Account Number (UAN).

A worker's UAN is unaffected even if they switch employers. As soon as a person changes jobs, their member ID also does, and the new ID is connected to their UAN. To utilize the services online, however, employees must activate their UAN.

Employees in both the public and private sectors are eligible for the Employee Provident Fund, therefore any employee can apply to join EPF India. Any company that employs at least 20 people is responsible for providing EPF benefits. Benefits Of EPF

The following is a list of advantages an EPF employee member may receive -

The EPF India deposit is eligible for a pre-fixed interest rate under the PF online plan. Further ensuring growth in the employees' money and accelerating capital appreciation are rewards extended at maturity.

The Employee Pension Scheme receives about 8.5% of an employer's contribution. The money contributed to the employee provident fund over time aids in creating a strong retirement fund. After retirement, having such a corpus would provide individuals a feeling of freedom and financial security.

Life is full of uncertainty. The best thing a person can do to deal with emergencies is to be financially prepared to handle such unforeseen circumstances. An EPF fund serves as an emergency reserve when a person needs money right away.

Employee contributions to their PF account are regarded as being exempt from taxation under Section 80C of the Indian Income Tax Act. Additionally, EPF plan earnings are not subject to taxation. Up to a maximum of Rs. 1.10 Lakhs, this exemption is available.

The Employees Provident Fund scheme's tax advantages ensure that members will receive larger earnings. Long-term savings and a person's purchasing power are both enhanced by it.

Members of EPF India are eligible to receive partial withdrawal benefits. People can withdraw money from their PF accounts to suit their individual needs, such as paying for higher education, building a home, paying for a wedding, or receiving medical care.

However, there is a lock-in period, before which any fraction of EPF cannot be withdrawn.

Related Aadhaar Articles:

How to Change Mobile Number in Aadhar Online

How to Check Aadhaar Card Link with Mobile Number

How to Download Aadhar card Download without Mobile Number

How to Change Date of Birth in Aadhar Card

How to Change Mobile Number in Aadhar without OTP

How to Link EPF Account with Aadhar

Income Tax Aadhar Link

Aadhar Bank Link

Link Aadhaar with Mobile Number

Pan Aadhaar Link

Link Voter ID with Aadhaar Card

Link UAN with Aadhaar Card

Ration Card Aadhar Link

Download E-Aadhaar Card

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?