Did you know that you can now share your Aadhaar number in a more secure and convenient way?

Read on to know more.

It is a new initiative by the UIDAI to secure your data while making it more shareable. This will help an organization to verify your identity without having to collect or store your Aadhaar number.

The file that will be generated will be password-protected, and will have the following information-

Name

Address

Photo

Gender

Date of Birth

Hash of registered mobile number

Hash of registered Email ID

Reference ID, which will be the last four digits of the Aadhaar number

Please note that to avail of this service, you will need to link your mobile number to your Aadhaar card. Without this, you will not be able to choose this method of verification.

There are many advantages to using the Aadhaar Paperless Offline e-KYC. Some of them are listed here-

You can share your information directly, without the knowledge of the UIDAI

Your Aadhaar number is not revealed, which means it is secure

No core biometrics are required for verification

You can decide with whom you want to share your data

The UIDAI digitally signs it, thus it can detect tampering

It’s password protected, which prevents any unauthorized access

Apart from all of these points, it is also extremely easy to generate and share.

You need to follow these steps to generate your Aadhaar Paperless Offline e-KYC-

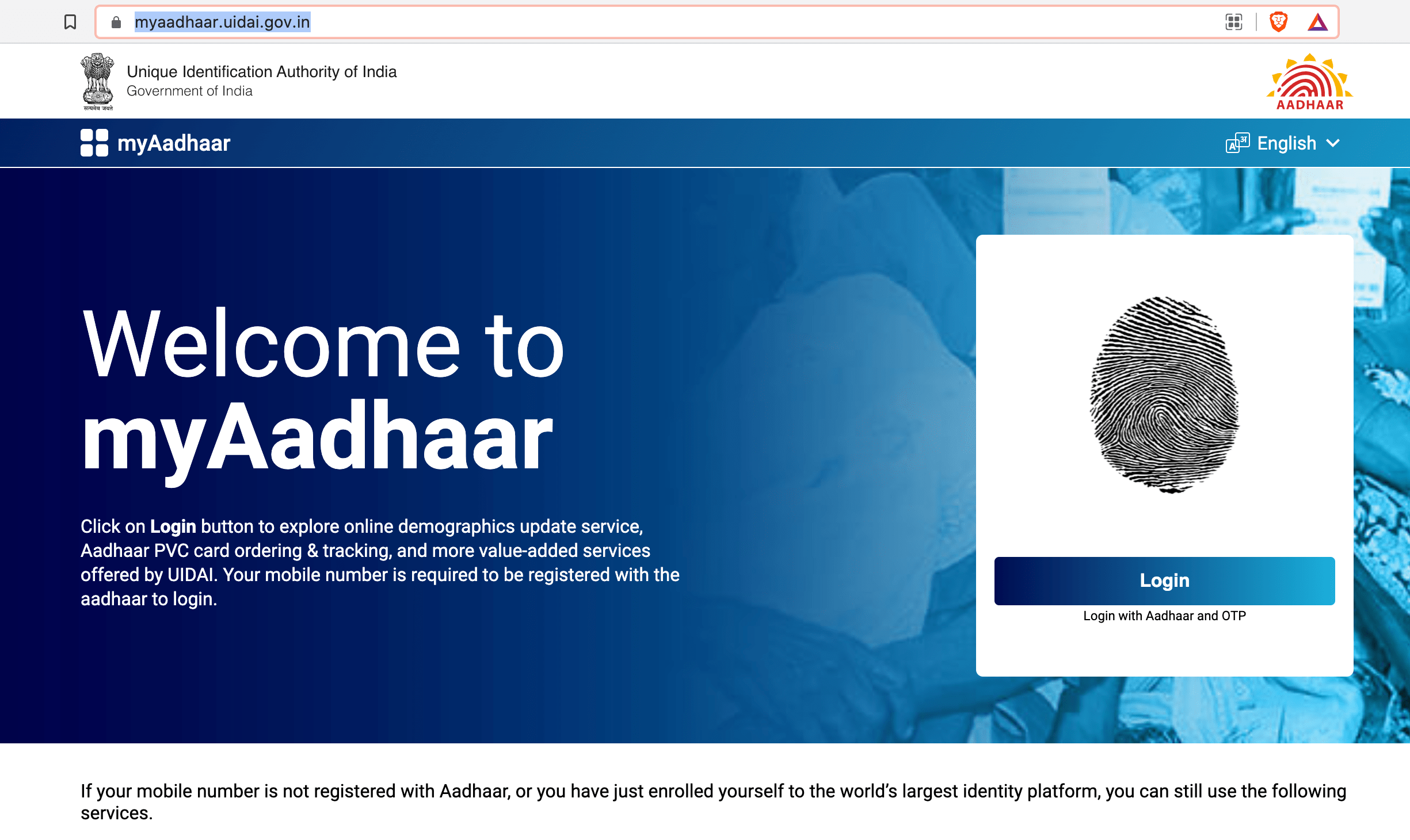

Go to the official myAadhaar website and log in using your Aadhaar number.

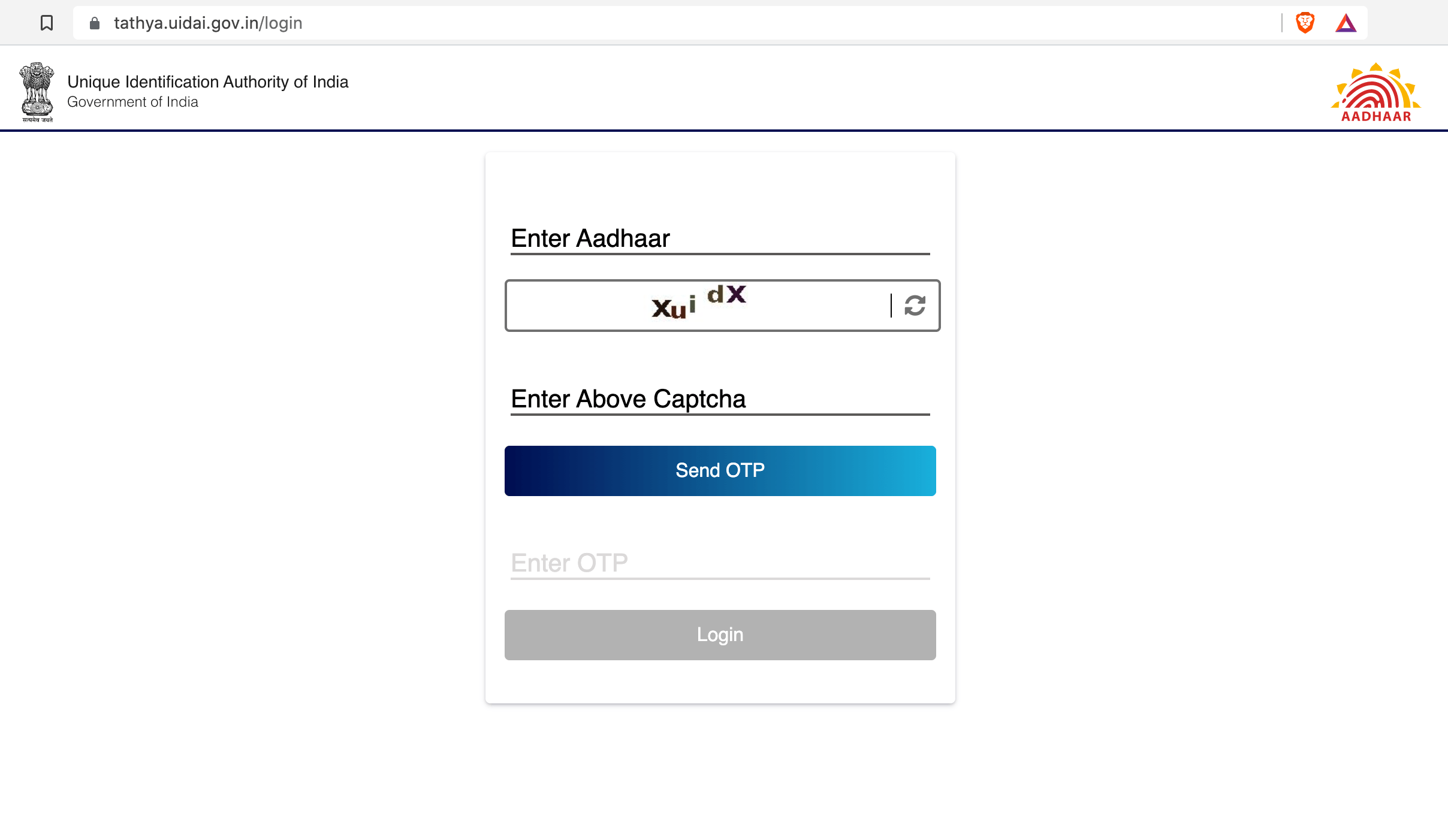

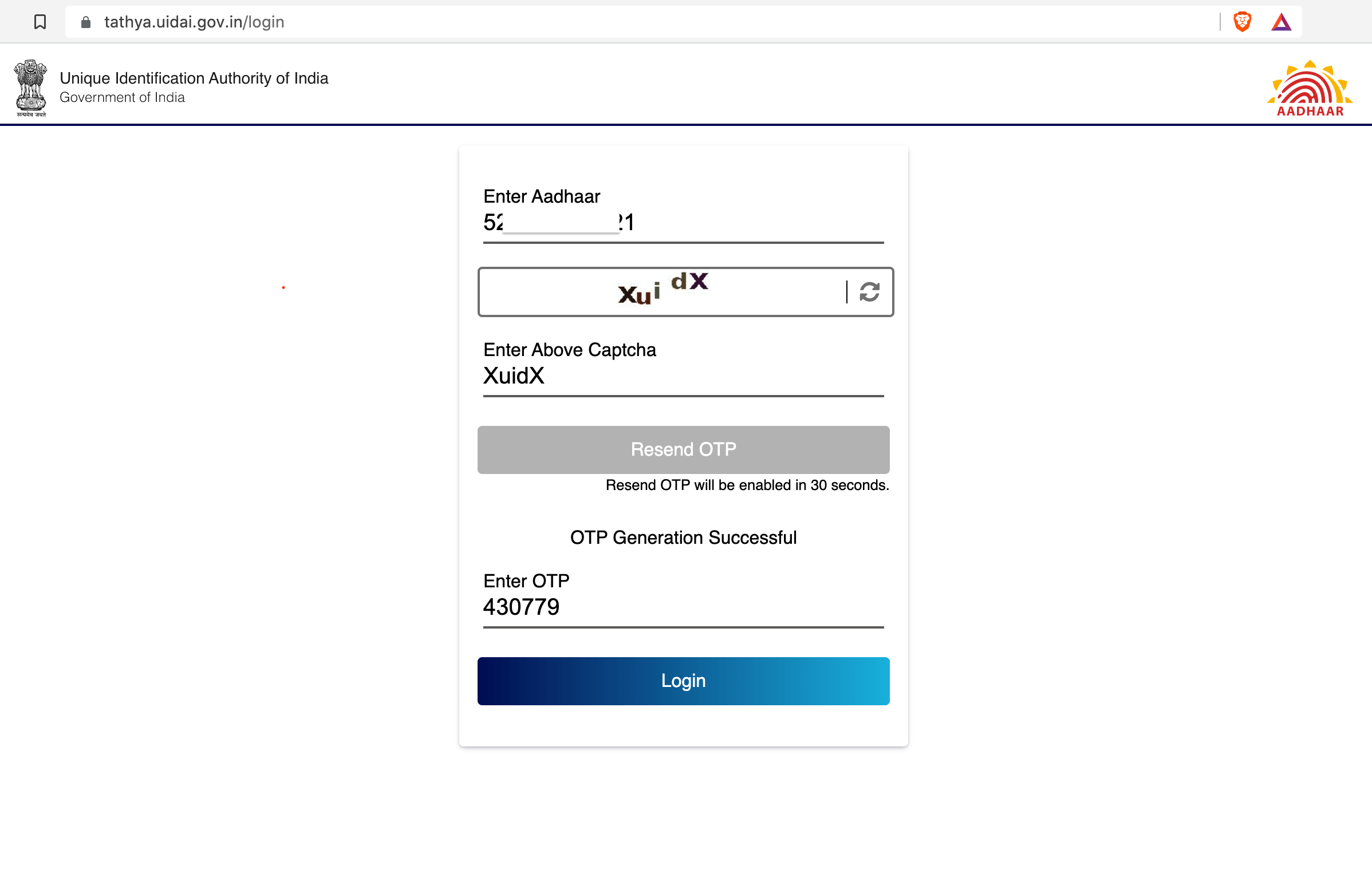

Enter the Captcha and click on ‘Send OTP’. Enter the OTP that you will receive in your registered mobile number to login.

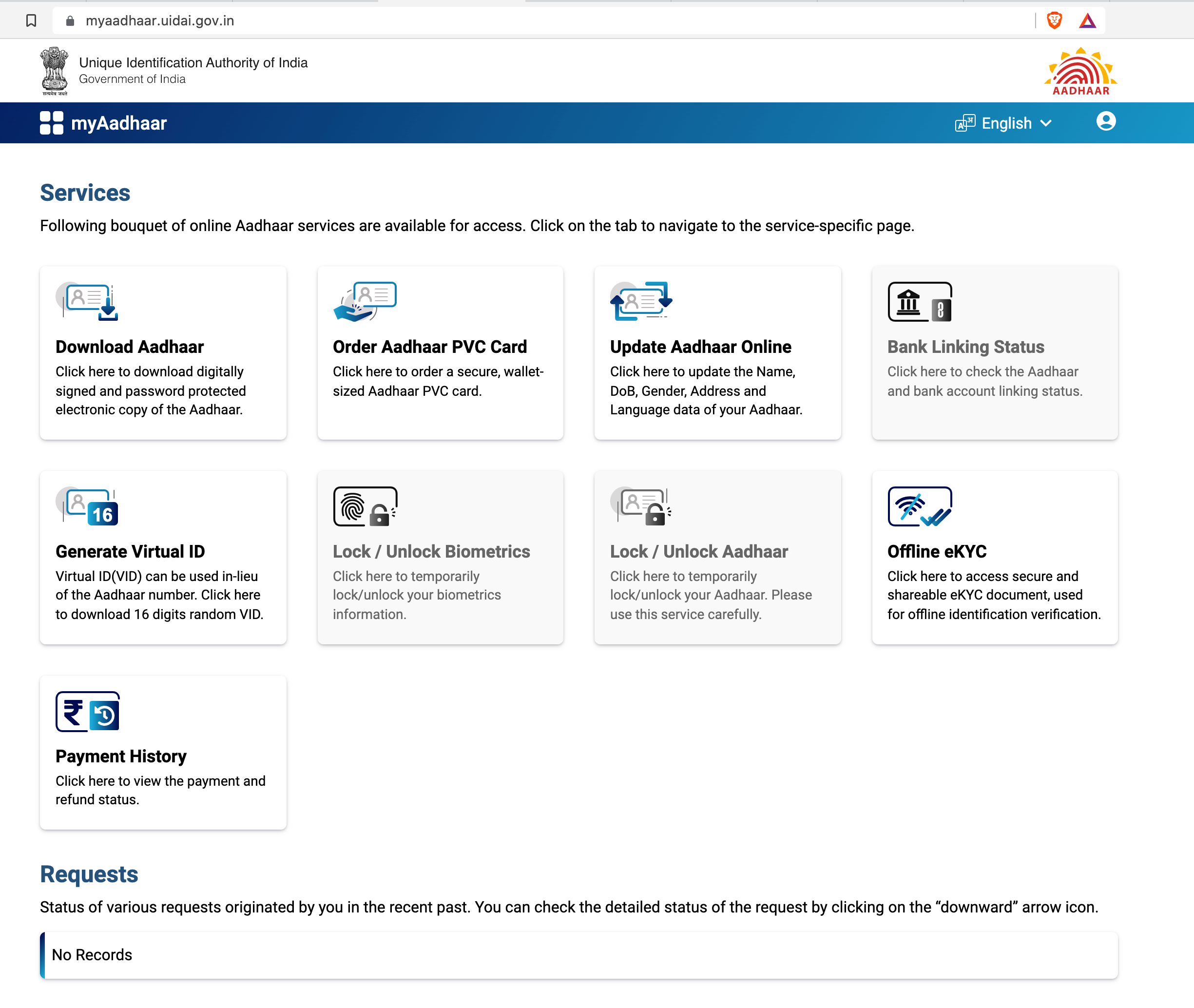

The list of services will open up, choose ‘Offline KYC’.

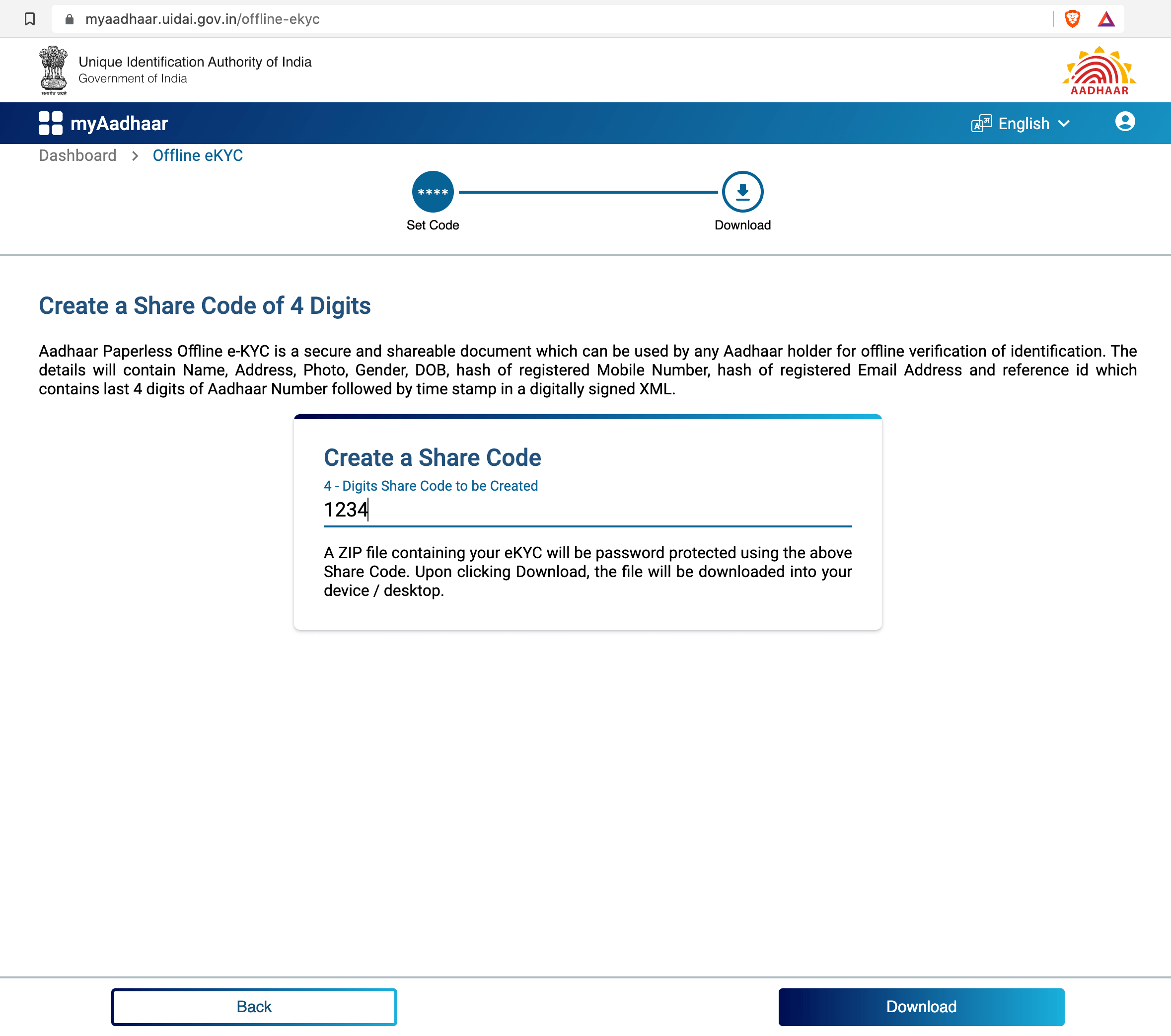

You will be asked to create a 4-digit share code. Input the code of your choice and remember it. You will need to enter this 4-digit share code with anyone whom you want to share the Zip file.

Finally. click on ‘Download’. A Zip file will be downloaded.

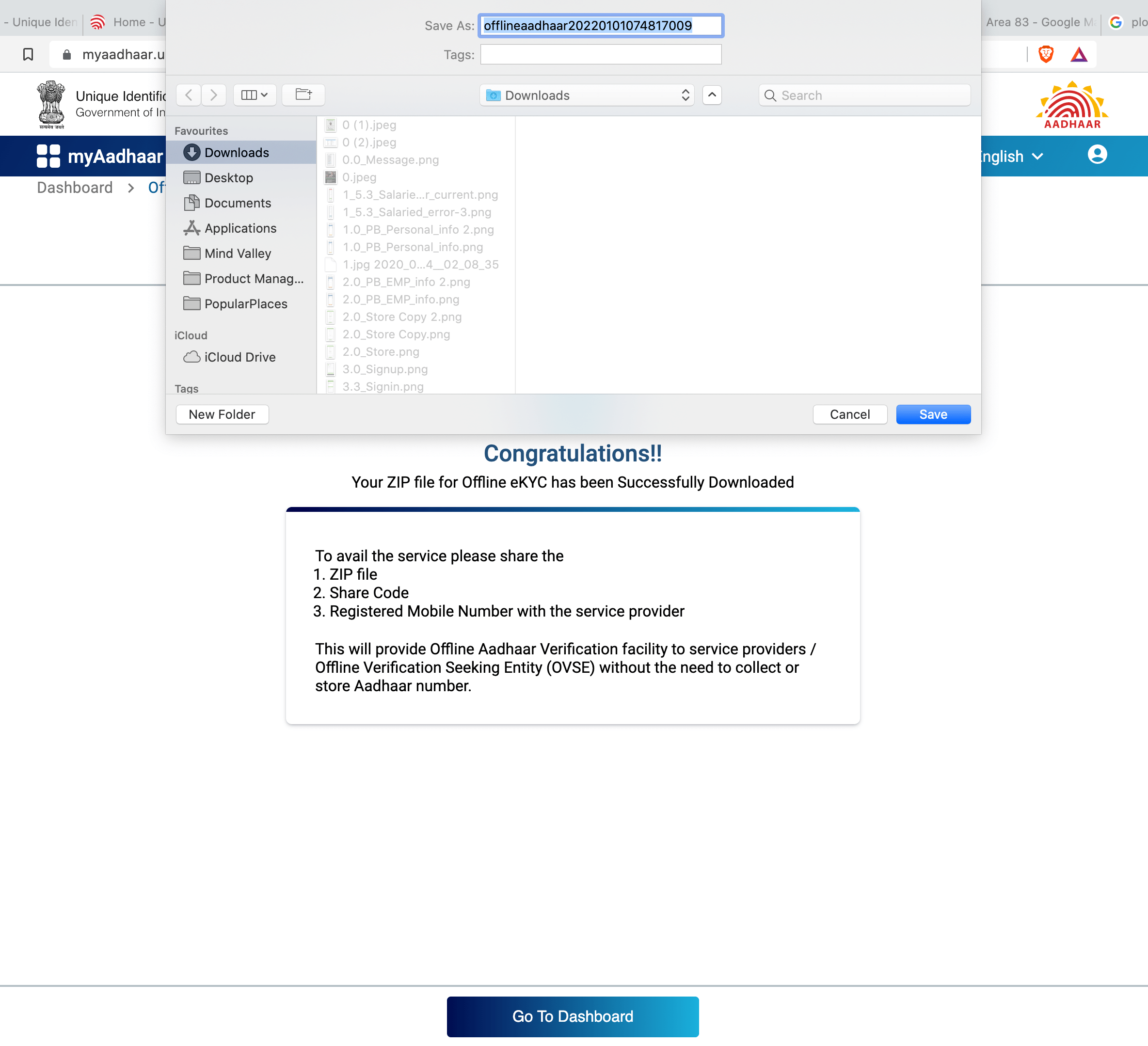

Now that you have downloaded the file, you can follow these steps to extract it and share it further.

Go to the ‘Downloads’ section of your system.

Right click on the Zip file that got downloaded, and select the ‘Extract’ option. If it asks for a password, enter the 4-digit share code that you had created.

Your Paperless Offline e-KYC is ready.

You can easily share the downloaded zip file with whomever you want. Note that no one will be able to access the file without entering the 4-digit share code.

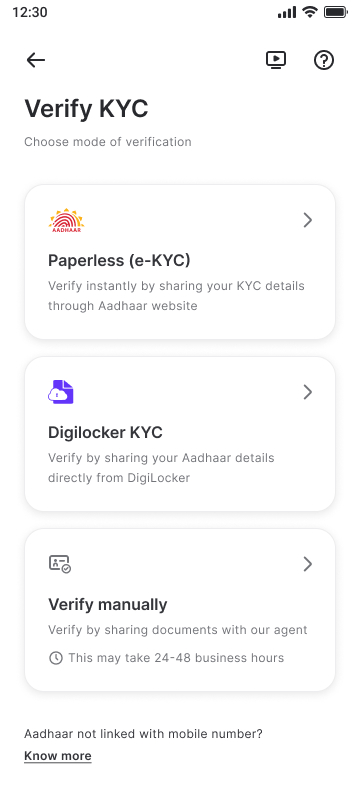

Verify your KYC instantly using your Aadhaar details & complete your loan application.

1. Visit the official myAadhaar website.

2. Click ‘Login’ on the Aadhaar website

3. Enter your 12-digit Aadhaar Number, Captcha & click on ‘Send OTP’

4. Enter the OTP received on your Aadhaar registered mobile number to login

5. Click on ‘Offline eKYC’

6. Create a 4-digit share code. Please do remember the code & click ‘Download’

7. Your Aadhaar ZIP file will be downloaded to your mobile or computer.

Yes, you can even use your Aadhaar Paperless Offline e-KYC on various instant loans apps like Moneyview. Here is how you can do it-

STEP-1: Choose the paperless e-KYC option while verifying your KYC.

STEP-2: On the next screen, enter your Aadhaar number and the captcha.

.jpg)

STEP-3: On the Moneyview app, your Zip file is generated by itself. You just have to create your 4-digit share code. Click on continue.

Note that this share code can be any random 4-digit number. This share code will be used by Moneyview to safely access your KYC document.

.jpg)

STEP-4: If you have used another number to apply for the loan, you will have to enter your Aadhaar verified number on the next screen.

STEP-5: Your KYC will be verified and you will see your information on the screen.

We, at Moneyview, use the data that you share strictly for defined purposes only. Your data is never shared with any third party without your knowledge.

Loan Amount

Min ₹5,000

Max ₹6,000,000

Rate of Interest

Min 6%

Max 36%

Loan Tenure

5

months

Min 3 months

Max 72 months

The offline e-KYC is a hassle-free, easy to use, and secure way to verify your identity. Even the vendors can quickly check the customer’s identity without having to check and store their Aadhaar number.

If you are looking for a personal loan of up to Rs. 5 lakh that comes with low interest rates, instant disbursement, and a hassle-free application process, apply for a Moneyview personal loan today.

Need Quick Cash?

All Aadhaar card holders whose mobile number is linked to their Aadhaar and who want to establish their identity in a paperless and secure manner can make use of this service.

Tax, Filing & Linking Guide

Aadhaar Card Help and Update Guides

Finance and Banking Articles

Banking & Investment Tips

Credit Card Insights

CIBIL Score Check and Boost Guide

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?