Understanding the differences between the two popular debt instruments

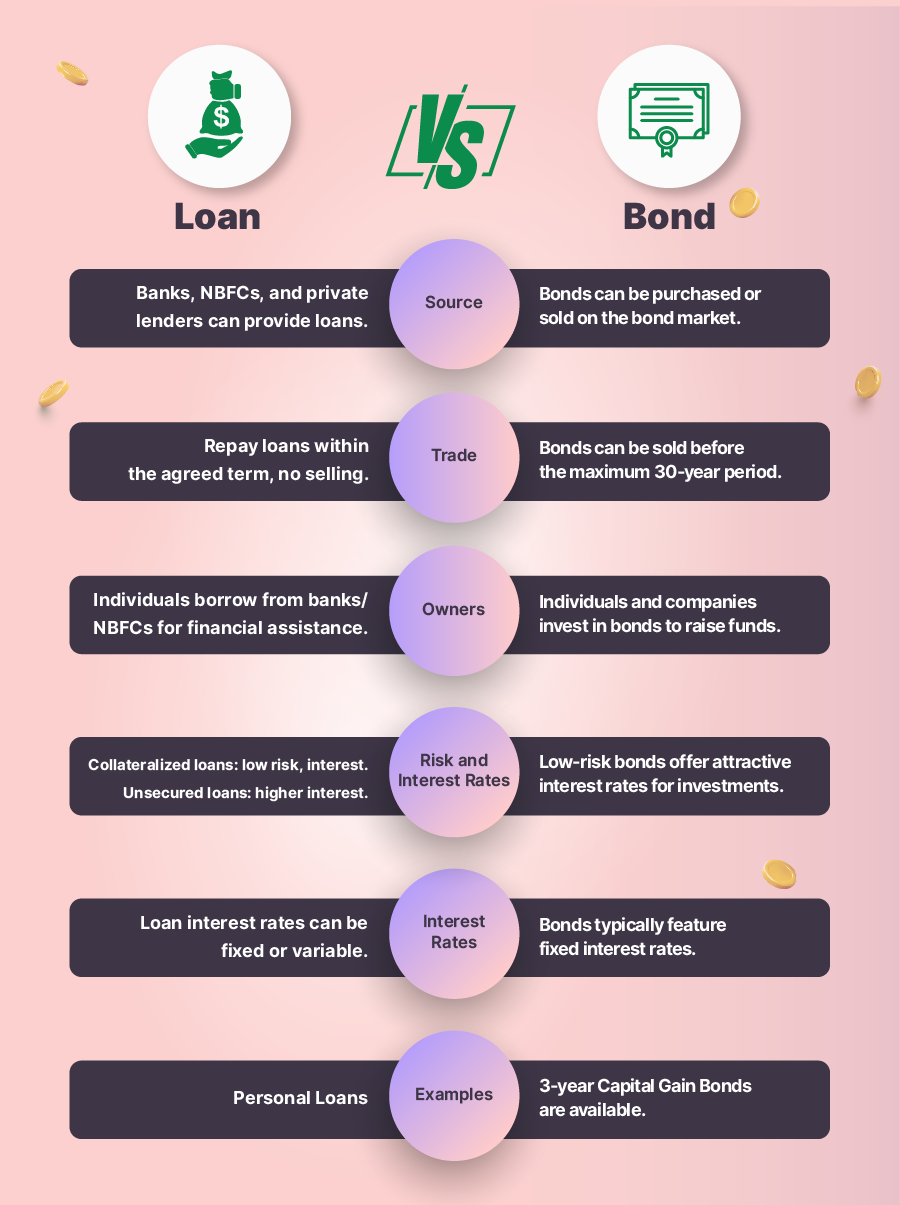

| Feature | Bonds | Loans |

|---|---|---|

| Source | Bonds can be sold or bought from a bond market | Loans can be availed from banks, NBFCs or other private lenders |

| Trade | Bonds can be sold before the maximum period of 30 years | Loans cannot be sold and will have to be repaid within the decided repayment term |

| Interest Rates | Bonds usually come with fixed interest rates | Interest rates on loans can be fixed or variable |

| Owners | Bonds are usually availed by private individuals as an investment from the government or large companies looking to raise funds | Loans are availed by private individuals generally for financial assistance from banks or NBFCs |

| Risk and Interest Rates | The risk associated with bonds is quite low and can also be considered as an investment. Therefore the interest rate offered is quite low | Loans that require collateral are considered to be low risk and therefore come with lower interest rates whereas unsecured loans have a higher interest rate |

| Examples | 3 years Capital Gain Bonds | Personal Loans |

While bonds and loans may seem similar at first glance, there are quite a few differences between them as given below -

There are multiple investment options for individuals to choose from and one of them is a bond. Bonds are a debt instrument wherein the company issuing the bond ‘borrows’ money from the lender i.e., you as a bond holder. In return, the bond issuing company must pay interest on the principal amount. This interest is also referred to as a coupon.

Most of us have borrowed money in the form of loans whenever we needed monetary help. In a similar way companies or even the government may require funds for programs or infrastructure. In such cases rather than borrowing from a bank, bonds are issued to the public.

Investors who purchase these bonds help these entities that require monetary help. Therefore, it is similar to a regular loan where the investor is considered as a lender.

Loan Amount

Min ₹10

Max ₹10,000,000

Rate of Interest

Min 5%

Max 25%

Loan Tenure

5

months

Min 3 months

Max 72 months

Given below are some of the salient features and benefits of bonds:

A loan is a form of debt that is availed by individuals or companies. A sum of money is borrowed from a lending institution for various purposes and is then repaid to the lender in installments at a specific rate of interest and over a pre-decided repayment period. There are many types of loans available in the market today such as education loans, personal loans, home loans, etc.

Given below are some of the salient features and benefits of loans -

Bonds and loans have a number of similar features and benefits but are not the same. From the perspective of a private individual, a bond is a debt instrument that can be purchased as a form of low-risk investment and one can receive an interest payment on the same. On the other hand loans are availed by private individuals when they require financial assistance and then repay the same to the lender along with an interest rate. Both are beneficial in their way and serve unique purposes. Choosing a debt instrument based on your requirements and financial goals is important.

If you are looking for a personal loan of up to Rs. 5 lakh that comes with low interest rates, instant disbursement, and a hassle-free application process, apply for a Moneyview personal loan today.

Need Quick Cash?

Here are some of the use cases for personal loans -

Emergency Expenses

Debt Consolidation

To Repay Credit Card Dues

Business Ventures

Home Remodeling

Dream Vacations

Fund Education

Buy a Gadget

Down Payment for other Loans

Servicing or Modifying your vehicle

Tax, Filing & Linking Guide

Personal Loan Types and Comparisons

Personal Loan Insights and Guides

Banking & Investment Tips

Credit Card Insights

CIBIL Score Check and Boost Guide

Disclaimer

The starting interest rate depends on factors such as credit history, financial obligations, specific lender's criteria and Terms and conditions. Moneyview is a digital lending platform; all loans are evaluated and disbursed by our lending partners, who are registered as Non-Banking Financial Companies or Banks with the Reserve Bank of India.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult with your financial advisor for specific guidance.

Was this information useful?