How to Choose the Best Loan Offer for a Used Bike

Given below are certain steps you need to follow to select and avail the right loan for you -

A credit score is a representation of how creditworthy you are. The higher the credit score, the lower is the risk for the lender making it easier for you to avail of a loan at low-interest rates. A CIBIL score or an Experian score of 650 or above is generally acceptable.

Having a high income is always advantageous but if you already have multiple loans running at the same time then the chances of getting an affordable loan offer decreases. Similarly, salaried applicants are more likely to receive better loan offers as the repayment risk for lenders is lower.

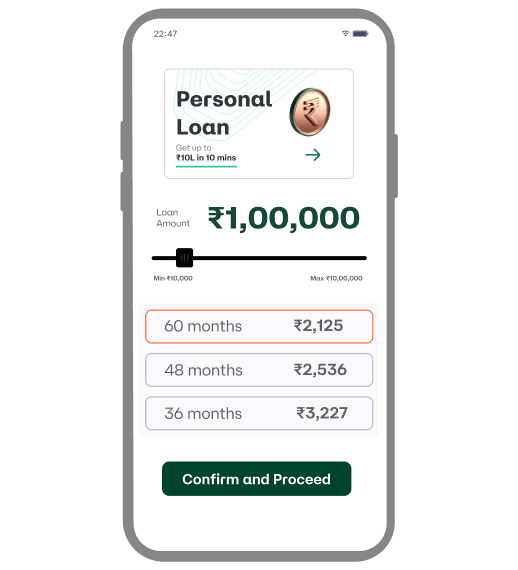

Everyone’s requirements will vary and it is important to choose a loan amount and tenure that suits your needs the best. Do not get tempted by attractive offers on two wheelers that you do not need or cannot afford. At the end of the day, all loans need to be repaid therefore choose one that is affordable.

- Ask Questions and Compare

It is important for you to understand all the terms and conditions involved in the loan agreement. Ask questions to find out all the details. Additionally, you don’t have to settle for the first loan offer that comes to you. Compare the rates and conditions offered by various lenders and opt for the one that suits your needs the best.

- Say no to credit card financing

Are you planning to take credit card loans? Steer clear of doing so. Not only will the interest rates be extremely high, it will also lead to severe repayment loads.

Where Can I Avail Financing for a Second-hand Bike?

You can get financing to purchase a used motorcycle from the following -

You can get direct loans from dealers who specialize in second-hand bikes where repayment depends on you credit profiles and reports

Certain known manufacturers offer exclusive financing options on their vehicles. You can avail of these offers and repayments will be determined according to your repayment ability

One of the most popular options available - applicants can avail affordable personal loans from lenders such as Money View to purchase a second-hand bike. These loans do not require any form of collateral either