Why Should You Opt for Money View Personal Loans to Buy Mobile on EMI

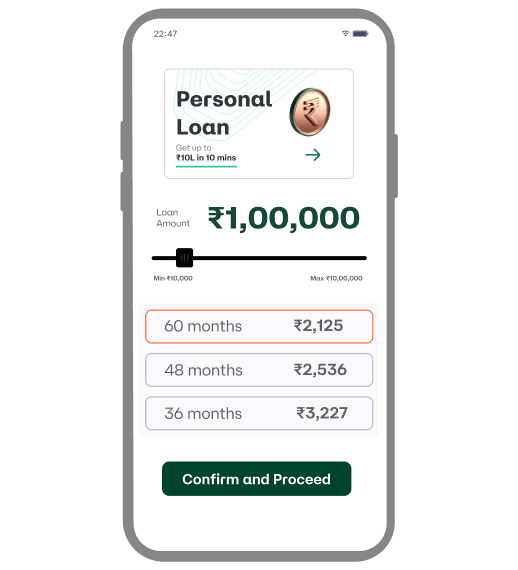

Flexibility of Loan Amount

Depending on your eligibility you can choose any loan amount of upto Rs. 10 lakhs.

24 Hour Disbursement

Your loan amount will be credited within just 24 hours after the approval of your loan application.

No Collateral or Guarantor

There is no need for a guarantor or collateral to get a moneyview personal loan.

Affordable Interest Rates

At moneyview, the interest rate starts at just 1.33% per month.