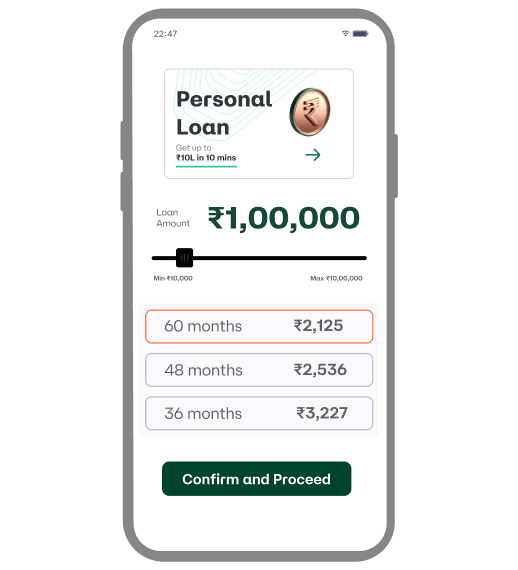

Home renovation loans are a great way to jazz up your home interiors. You can use moneyview’s instant personal loans as house renovation loans to give a new look to your home without worrying about the funds.

Personal Loan for Home Renovation

Home renovation loan interest rates of banks and NBFCs are similar to home loans. However, as home loans are high-ticket loans, they come with stringent conditions for lending like a high credit score and a high take-home income. The process also requires a lot of documents.

On the other hand, personal loans from moneyview can be procured with low credit scores and minimal documentation and can easily be used as home renovation loans.

Eligibility Criteria for moneyview Home Renovation Loan

You can avail of affordable house renovation loans from moneyview by fulfilling the eligibility criteria listed below -

-

Your age must be between 21 and 57 years

-

You must have a monthly income of at least Rs.13,500 if you are salaried

-

You must have a monthly income of at least Rs.15,000 if you are self-employed

-

Your income must be credited directly to your bank account.

-

You must have a minimum CIBIL or Experian score of 650

Documents Required for moneyview House Renovation Loan

The documentation required for procuring a home renovation loan from moneyview is very simple. All you will have to do is -

-

Confirm or enter your PAN number

-

Ensure that your mobile number is linked to your Aadhaar card for KYC verification

-

Provide a clear selfie taken in a well-lit area

Please note that the documentation requirements will vary based on your profile. You may be required to upload proof of address, bank statement, and other supporting documents.

In case you are required to upload proof of address, any one of the following documents will suffice -

-

Aadhaar Card

-

Valid Indian Passport

-

Valid Voter ID

-

Valid Driver’s License

-

Utility Bills (Electricity, Water, Gas) dated within the last 60 days

In case you are required to upload proof of income, you must furnish your bank statement for the last three months. This statement must also show your salary credits.

Fees and Charges for moneyview Home Renovation Loan

House renovation loan interest rates and other charges from moneyview are very affordable. They are listed below -

Conclusion

Funds procured from an instant personal loan can be used for a myriad of purposes. As house renovation loans from traditional banks may take a long time to get processed, you can use moneyview’s personal loans as house renovation loans.

This way you can get the money quickly without much hassle, right from the comfort of your home. To know more, visit the moneyview website or download the app!